Introducing Steel Dynamics (NASDAQ:STLD), The Stock That Dropped 37% In The Last Year

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Steel Dynamics, Inc. (NASDAQ:STLD) shareholders over the last year, as the share price declined 37%. That falls noticeably short of the market return of around 3.8%. On the bright side, the stock is actually up 20% in the last three years. The good news is that the stock is up 7.3% in the last week.

See our latest analysis for Steel Dynamics

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Steel Dynamics share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past. It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

Steel Dynamics's revenue is actually up 12% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

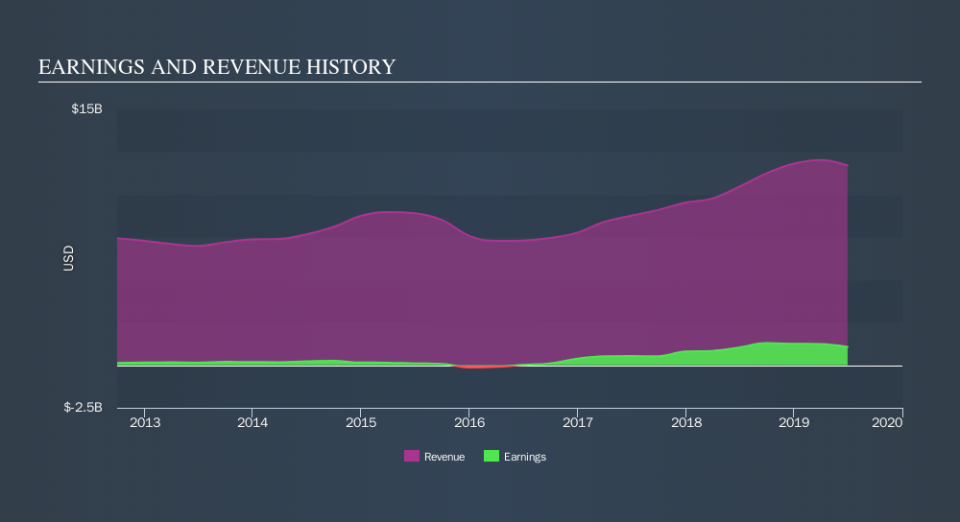

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think Steel Dynamics will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

We've already covered Steel Dynamics's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Steel Dynamics's TSR, which was a 36% drop over the last year, was not as bad as the share price return.

A Different Perspective

Investors in Steel Dynamics had a tough year, with a total loss of 36% (including dividends), against a market gain of about 3.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 6.5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Steel Dynamics is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.