Intuit Has Headwinds, but Shares Are Deeply Undervalued

Technology has been a very difficult place to invest over the last year, with the sector down 40% during this time. Shares of Intuit Inc. (NASDAQ:INTU) have declined right along with its peers, falling 38% over the last 12 months.

There are some risks to the name, but Intuit provides products and services that are in demand. For instance, TurboTax, QuickBooks, Credit Karma and Mint are used by consumers, small business owners, the self-employed and accounting professionals around the globe. Intuit provides these products and services to more than 100 million customers, giving it a large customer pool with which to work.

This discussion will dive deeper into why I believe Intuit offers immense upside potential.

Earnings highlights

Intuit reported earnings results for the first quarter of fiscal year 2023 on Nov. 29, with the company easily topping what analysts were expecting. Revenue grew 29.4% to $2.6 billion and was $97 million above estimates. Adjusted earnings per share of $1.66 compared favorably to $1.53 in the prior year and was 46 cents more than anticipated.

The Small Business and Self-Employed Group, which accounts for the bulk of revenue, grew 38% to $2 billion. This business benefited from a strong showing in QuickBooks, driven by a healthy combination of customer growth, higher prices and mix.

Online services more than doubled to $681 million. The addition of Mailchimp, an engagement and marketing platform acquired in 2021, added $264 million of this growth. Even without the purchase of Mailchimp, online services still grew a healthy 28% due to strength in QuickBooks Online payroll and payment platforms.

Revenue for Credit Karma grew 2% to $425 million. This business, which was acquired for $8.1 billion in late 2020, had growth in its credit card business. However, higher interest rates led to declines in home loans, personal loans and auto loans and insurance.

Leadership presented updated guidance for the fiscal year, with Intuit now expected to produce revenue of $14.035 billion to $14.25 billion, down from a prior forecast of $14.49 billion to $14.7 billion. Still, this would be 11% growth at the midpoint from fiscal year 2022. Adjusted earnings per share are still projected in a range of $13.59 to $13.89, which would equate to 15% to 17% growth.

Takeaways

Perhaps the most pressing issue for Intuit is the companys addition of Credit Karma. Originally, the company had forecasted growth of 10% to 15% for the segment. Now, Intuit expects the business to decline 10% to 15% from the previous year. This is a substantial swing in forecasts and no small matter as Credit Karma contributed 16% of first-quarter revenue.

As seen in the most recent reporting period, higher interest rates pressured loans for the business. Interest rate hikes may be slowing, but rates are significantly higher today then they were a year ago. This pressure is likely to continue for Credit Karma until, at the very least, high-rate periods are lapped.

The good news is Credit Karma is just a small portion of the total business. The Small Business and Self-Employed Group is producing high levels of growth even when excluding revenue from Mailchimp. Intuits tax offerings, which include the combination of both software and accountants, has helped to foster an ecosystem that keeps customers in the fold and likely to continue paying for services. A similar buildout of QuickBooks is also taking place, with the most recent quarter showing robust increases in revenue.

These tailwinds should help drive growth, something Intuit has a long history of doing.

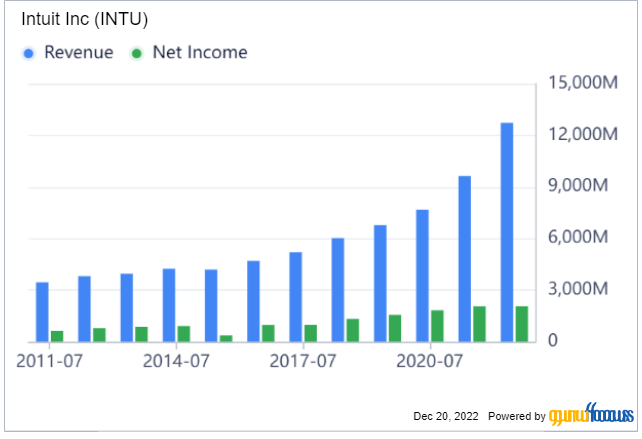

Revenue growth has been consistently good over the long term as the compound annual growth rate is above 13% over the last 10 fiscal years, according to Value Line. Net income and earnings per share growth has been slightly higher at 15.7% and 16.6% over this same period. Bottom-line improvement came partially due to a small reduction in the share count, but the net profit margin improved 310 basis points between 2013 and 2022.

Even with the headwind of higher interest rates, revenue was still higher by a sizeable amount and revised guidance still points toward double-digit top-line growth.

As a result of the negative impact of Credit Karma, revenue forecasts were lowered for the fiscal year, though this is only slightly below the long-term average growth rate. Interestingly, adjusted earnings per share was reaffirmed to be 16% at the midpoint, showing that management expects margins to stay high. Share buybacks will also help here as well.

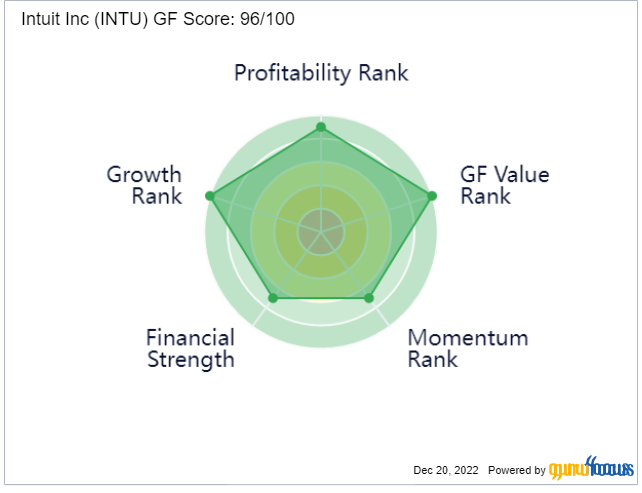

Intuit has a GF Score of 96 out of 100, implying outperformance based on a historical study by GuruFocus. This score reflects perfect ratings for growth and value as well as high ranks for profitability, financial strength and momentum.

Valuation analysis

With the stock trading at $391.64, shares of Intuit are trading at a forward price-earnings ratio of 28.5. This is below the five- and 10-year average price-earnings ratios of 36.4 and 31.2.

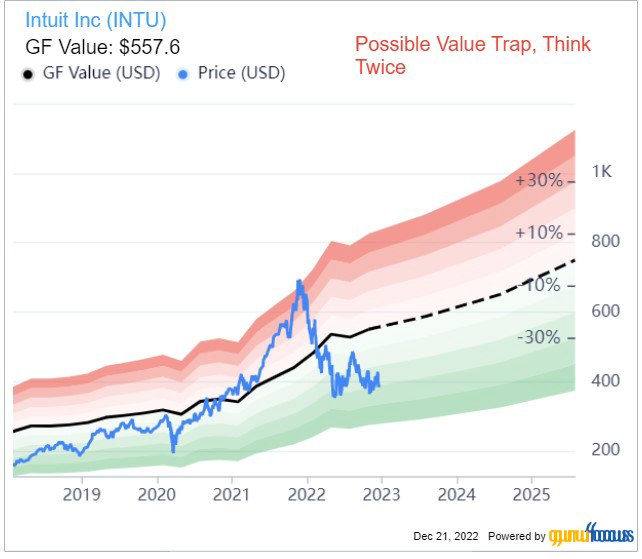

The GF Value chart also shows the stock is trading below fair value.

Intuit has a GF Value of $557.60, giving the stock a price-to-GF Value ratio of 0.70. Shares could return as much as 43% if they were to reach their GF Value.

Lastly, the yield is low at just 0.8%, but this is not due to a lack of effort on the part of the company. Intuits dividend has a CAGR of almost 17% over the last decade.

Final thoughts

The most recent quarter was mostly positive for Intuit. Revenue and earnings proved to be above estimates. Higher interest rates are keeping a lid on demand for loans in the Credit Karma segment, but most of the business is doing quite well.

Intuit does have a rating of possible value trap from GuruFocus. Caution should always be exercised when assessing potential return potential. However, historical performance in combination with a review of the most recent quarter show that Intuit is a top name in its industry and will likely continue to be so as the company has multiple tailwinds that are overcoming the negative impact of Credit Karma on the business.

Rarely has Intuit been this undervalued relative to its historical multiples and its GF Value as it is right now. With much of the business demonstrating high rates of growth and the valuation lingering at a very reasonable level, it could be an excellent opportunity.

This article first appeared on GuruFocus.