Intuit (INTU) Introduces QuickBooks Workforce Application

Intuit INTU recently launched the new QuickBooks Workforce mobile app for business employees in the United States, Canada, Australia and U.K. This platform will help employees manage their work, pay and benefits in one place.

The Intuit QuickBooks Workforce application is a centralized employee hub, which automates and reduces administrative tasks for the employees, with a single-sign-on experience, and helps them focus on their work with confidence.

Available for Android and iOS, the QuickBooks Workforce app offers employees in the United States and Canada with features like getting access to their pay stubs and tax documents in addition to having the ability to access important on-the-job tools, including time-tracking, scheduling and paid time off. This saves their time and reduces payday anxiety.

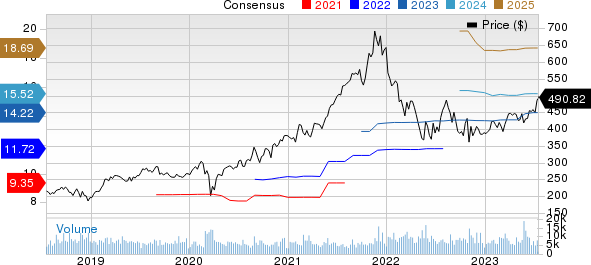

Intuit Inc. Price and Consensus

Intuit Inc. price-consensus-chart | Intuit Inc. Quote

The company has a strong momentum in online ecosystem revenues and solid professional tax revenues. Its strategy of shifting its business to cloud-based subscription model will help generate stable revenues over the long run. In June, INTU expanded its platform architecture with the introduction of a proprietary Generative Artificial Intelligence (AI) Operating System (GenOS).

Intuit GenOS features custom-trained financial large language models (LLMs) that specialize in solving tax, accounting, marketing, cash flow and personal finance challenges. The LLMs, combined with the company’s network of domain experts and data protection controls, intend to provide actionable insights and invoke actions like contacting human experts.

In April, INTU released the beta version of its Email Content Generator solution, which is part of a suite of Mailchimp AI-powered features. The launch aims at transforming email marketing for small and mid-size businesses.

The company’s Email Content Generator is developed using Intuit Mailchimp’s existing generative AI tools and the company’s AI-driven expert platform. It uses OpenAI’s GPT technology to aid marketers quickly generate content on brand marketing, get copy ideas and inspiration and test variants to offer better personalized and engaging email marketing campaigns to clients.

In February, Intuit introduced AI enhancements for its Virtual Expert Platform to drive highly-personalized experiences, connecting consumers with experts and reducing tax filing time with its portfolio of TurboTax Live products.

In January, the company increased the availability of its QuickBooks Business Network solution among millions of small and mid-market businesses in the United States. This was done to enable eligible QuickBooks Online customers in the United States to easily connect with each other in the business-to-business network.

Zacks Rank & Other Stocks to Consider

Intuit currently carries a Zacks Rank #2 (Buy). Shares of INTU have gained 26.5% in the past year.

Some other top-ranked stocks from the broader Computer and Technology sector are Salesforce CRM, NVIDIA Corporation NVDA and Meta Platforms META. While Salesforce and NVIDIA sport a Zacks Rank #1 (Strong Buy), Meta carries a Zacks Rank #2 at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Salesforce’s second-quarter fiscal 2024 earnings has been revised northward by a penny to $1.90 per share over the past 30 days. For fiscal 2024, earnings estimates have moved up by 2 cents to $7.44 in the past 30 days.

CRM's earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 15.5%. Shares of the company have gained 35.7% in the past year.

The Zacks Consensus Estimate for NVIDIA’s second-quarter fiscal 2024 earnings has been revised northward from $1.04 to $2.04 per share over the past 60 days. For fiscal 2024, earnings estimates have moved up by 2 cents to $7.66 in the past 30 days.

NVDA's earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missing twice, the average surprise being 0.26%. Shares of the company have soared 188.6% in the past year.

The Zacks Consensus Estimate for Meta Platforms' second-quarter 2023 earnings has been revised upward by a penny to $2.83 per share over the past seven days. For 2023, earnings estimates have moved north by 3 cents to $11.97 in the past seven days.

META’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missing twice, the average surprise being 15.5%. Shares of the company have surged 85.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report