Intuit (INTU) Launches 'Business Differently' Brand Platform

Intuit INTU recently announced the launch of a global QuickBooks brand platform called "Business Differently." This platform is focused on reaching solopreneur small business owners.

The marketing campaign, created in partnership with QuickBooks' creative agency FCB and other agencies, features a TV spot with football star Saquon Barkley highlighting a solopreneur sports photographer. The campaign extends to social media, influencers and a new solopreneur content hub on the QuickBooks blog.

Activation across various social media platforms depicts how real solopreneurs are doing "business differently" with personal stories and creative storytelling.

As solopreneur businesses grow, they can seamlessly upgrade to the full range of solutions the QuickBooks platform offers, including accounting, payroll, workforce management and more.

This initiative by Intuit aims to emphasize that QuickBooks offers more than just accounting services, providing dynamic money management tools to help small businesses operate on their own terms.

The company also introduced QuickBooks Money, a subscription-free payments and banking solution designed for solopreneurs to get paid and manage their money without monthly fees or minimum balance requirements.

It combines QuickBooks Checking and QuickBooks Payments. QuickBooks Money offers an APY of 5.00%, which is more than 70 times the U.S. average, providing a competitive financial incentive for users.

QuickBooks Money is targeted toward the company’s Small Business and Self-Employed Group segment, which accounted for 56% of total revenues in fiscal 2023 compared with 51% in fiscal 2022.

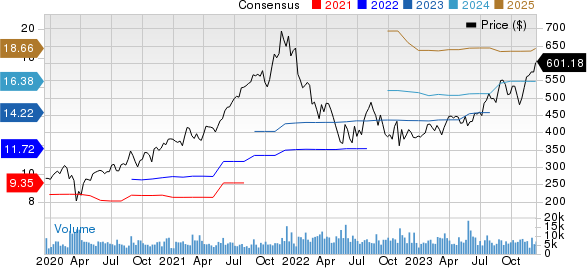

Intuit Inc. Price and Consensus

Intuit Inc. price-consensus-chart | Intuit Inc. Quote

Intuit Benefits From Robust Product Portfolio

Intuit is benefiting from strong momentum in online ecosystem revenues and solid professional tax revenues. The TurboTax Live offering is also driving growth in the Consumer tax business. Solid momentum in the company’s lending product, QuickBooks Capital, is an upside.

Moreover, the company’s strategy of shifting its business to a cloud-based subscription model will help generate stable revenues. Intuit expects double-digit revenue growth and margin expansion in fiscal 2024.

The newly introduced Generative AI-based feature — Intuit Assist — added to all its major solutions, including Intuit TurboTax, Credit Karma, QuickBooks and Mailchimp, is expected to be a game changer.

Intuit Assist is powered by GenOS, which is built on OpenAI’s large language model. It leverages Intuit's ecosystem and database to offer personalized recommendations to both B2C and B2B customers.

TurboTax utilizes Intuit Assist to customize tax checklists and provide answers, insights and suggestions tailored to customers' needs. It draws upon Intuit's tax expertise, AI-driven Tax Knowledge Engine and proprietary data to provide this facility.

The users of Credit Karma can seek personalized financial recommendations, develop strategies and optimize their monthly spending.

For the second quarter of fiscal 2024, INTU expects revenues to grow between 11% and 12% on a year-over-year basis in the band of $3.362-$3.392 billion. Non-GAAP earnings for the quarter are estimated in the range of $2.25-$2.31 per share.

The Zacks Consensus Estimate for fiscal second-quarter 2024 revenues is pegged at $3.39 billion, indicating 11.37% year over year. The consensus estimate for earnings is pegged at $2.28 per share, down 10.2% over the past 30 days.

Zacks Rank and Stocks to Consider

Intuit currently carries a Zacks Rank #3 (Hold). Shares of the company have rallied 54.5% year to date, outperforming the Zacks Computer and Technology sector’s return of 49.1%.

Some better-ranked stocks from the broader technology sector are MongoDB MDB, Cloudflare NET and Bel Fuse BELFB. While BELFB sports a Zacks Rank #1 (Strong Buy), MDB and NET carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MongoDB's fourth-quarter 2024 earnings has been revised 10 cents northward to 46 cents per share in the past 30 days. For fiscal 2024, earnings estimates have moved upward by 56 cents to $2.90 per share in the past 30 days.

MDB’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 277.91%. Shares of MDB have gained 108.9% year to date.

The Zacks Consensus Estimate for Clouflare's fourth-quarter 2023 earnings has moved northward by 2 cents to 12 cents in the past 60 days. For fiscal 2023, NET’s earnings estimates have been revised 9 cents upward to 46 cents per share in the past 60 days.

Cloudflare’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 63.22%. Shares of NET have gained 77.8% year to date.

The Zacks Consensus Estimate for Bel Fuse’s fourth-quarter fiscal 2023 earnings has been revised upward by 38 cents to $1.44 per share in the past 60 days. For fiscal 2023, earnings estimates have been raised by 72 cents to $6.28 in the past 60 days.

Bel Fuse’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 56.92%. Shares of Bel Fuse have surged 89.2% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuit Inc. (INTU) : Free Stock Analysis Report

Bel Fuse Inc. (BELFB) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report