Intuit (INTU) Launches New Generative AI-Powered Assistant

Intuit INTU recently introduced a new Generative AI-based feature — Intuit Assist — to all its major solutions, including Intuit TurboTax, Credit Karma, QuickBooks and Mailchimp. This feature consists of both digital and human assistance aspects with a standard user interface.

Intuit Assist is powered by GenOS, which is built on OpenAI’s large language model. It leverages Intuit's ecosystem and database to offer personalized recommendations to both B2C and B2B customers.

TurboTax utilizes Intuit Assist to customize tax checklists and provide answers, insights and suggestions tailored to customers' needs. It draws upon Intuit's tax expertise, AI-driven Tax Knowledge Engine and proprietary data to provide this facility.

The users of Credit Karma can seek personalized financial recommendations, develop strategies and optimize their monthly spending.

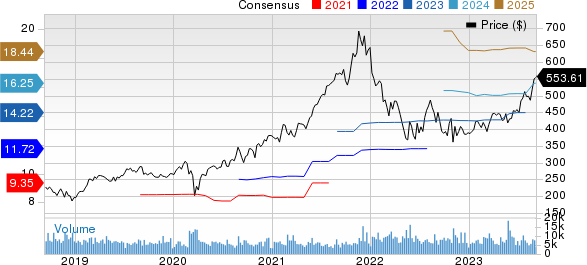

Intuit Inc. Price and Consensus

Intuit Inc. price-consensus-chart | Intuit Inc. Quote

Likewise, Intuit Assist will help small businesses using QuickBooks see cash flow hot spots, identify top-selling products and detect spending anomalies.

For marketers, Intuit Assist comes with capabilities that can streamline marketing efforts by managing end-to-end campaigns aligned with brand identity and intent. It will also assist in creating customizable emails in Mailchimp, help incorporate QuickBooks data and offer scheduling flexibility for marketing content.

Intuit Benefits From a Strong Portfolio

Intuit shares have rallied 41.6% year to date, outperforming the Zacks Computer and Technology sector’s return of 41.3%.

Intuit is benefiting from strong momentum in online ecosystem revenues and solid professional tax revenues. The TurboTax Live offering is also driving growth in the Consumer tax business. Solid momentum in the company’s lending product, QuickBooks Capital, is an upside.

Moreover, the company’s strategy of shifting its business to a cloud-based subscription model will help generate stable revenues. Intuit expects double-digit revenue growth and margin expansion in fiscal 2024.

For the fiscal first quarter of 2024, INTU expects revenues to grow between 10% and 11% on a year-over-year basis in the band of $2.86-$2.895 billion. Non-GAAP earnings for the quarter are estimated in the range of $1.94-$2 per share.

The Zacks Consensus Estimate for fiscal first-quarter 2024 revenues is pegged at $2.87 billion, indicating 10.6% year over year. The consensus estimate for earnings is pegged at $1.95 per share, unchanged over the past 30 days.

Zacks Rank & Stocks to Consider

Currently, Intuit carries a Zacks Rank #3 (Hold).

NVIDIA NVDA, Palo Alto Networks PANW and Splunk SPLK are some better-ranked stocks investors can consider from the broader sector.

NVIDIA and Splunk each sport a Zacks Rank #1 (Strong Buy), while Palo Alto has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for NVIDIA, Palo Alto and Splunk is pegged at 13.5%, 27.8% and 24.7%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report