Intuitive Surgical (ISRG) Gains Following Q1 Earnings Beat

Intuitive Surgical ISRG reported first-quarter 2023 adjusted earnings per share (EPS) of $1.23, which beat the Zacks Consensus Estimate of $1.19 by 3.4%. The bottom line improved 8.8% year over year. It also beat our earnings estimates by 5.1%.

GAAP EPS in the quarter was $1.00, flat year over year.

Revenue Details

This Zacks Rank #4 (Sell) company reported revenues of $1.7 billion, up 14% from the prior-year quarter’s number. Growth in da Vinci procedure volume contributed to the improvement, which was partially offset by foreign currency impacts. On a constant currency (cc) basis, revenues were up 17% from the year-ago period. The top line beat the Zacks Consensus Estimate by 7.6%. It also beat our estimates for total revenues by 7.9%.

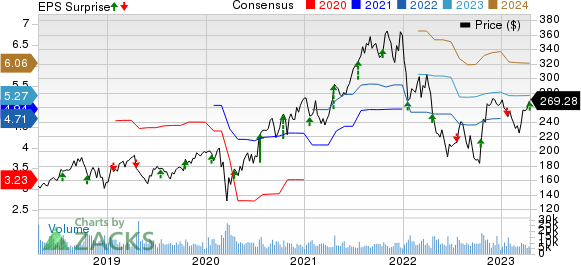

Intuitive Surgical, Inc. Price, Consensus and EPS Surprise

Intuitive Surgical, Inc. price-consensus-eps-surprise-chart | Intuitive Surgical, Inc. Quote

Segmental Details

Instruments & Accessories

Revenues at the segment totaled $986 million, indicating a year-over-year improvement of 22%. This can be attributed to da Vinci procedure’s 26% volume growth. The improvement was partially offset by foreign currency impacts and customer buying patterns. The procedure’s volume growth in the United States reflects a favorable comparison with the year-ago quarter, given the impact of COVID-19 last year. However, the procedure volume in China remained disrupted due to the pandemic.

Systems

In the reported quarter, System revenues were $427 million, flat year over year. Intuitive Surgical shipped 312 da Vinci Surgical Systems compared with 311 in the prior-year quarter. The company placed 141 systems in the United States compared with 186 in the year-ago quarter. Outside the United States, ISRG placed 171 systems compared with 125 in the prior-year period. Of these, 101 were in Europe, 16 in Japan and 18 in China.

Services

Services revenues were $283.2 million, up 7.6% from the year-ago quarter.

Margins

Adjusted gross profit was $1.14 billion, up 1% year over year. As a percentage of revenues, the gross margin was 67.2%, down 100 bps from the prior-year quarter.

Selling, general and administrative expenses were $480.5 million, down 2.8% from the year-ago period. The SG&A expense was 10.3% higher than our estimates of $435.7 million. Research and development expenses totaled $244.9 million, almost flat on a year-over-year basis. The figure beat our estimates of $222.5 million by 10.1%.

Adjusted operating income totaled $534.7 million, up 0.9% year over year. The figure was lower than our estimates of $539.3 million. As a percentage of revenues, the operating margin was 31.5%, down 50 bps quarter over quarter.

Financial Position

Intuitive Surgical exited the first quarter with cash, cash equivalents and investments of $6.58 billion compared with $6.74 billion in the previous quarter.

Total assets were $13.05 billion compared with $12.97 billion sequentially.

Wrapping Up

ISRG ended the first quarter on a strong note, wherein both revenues and earnings beat the consensus mark. The company witnessed continued growth in da Vinci procedure volume. However, resurgence of COVID-19 adversely impacted its procedure volume in China.

The contraction in both gross and operating margins indicates rising costs and expenses amid inflationary pressure. With an anticipated decline in operating expenses, the margins are likely to improve moving forward in 2023.

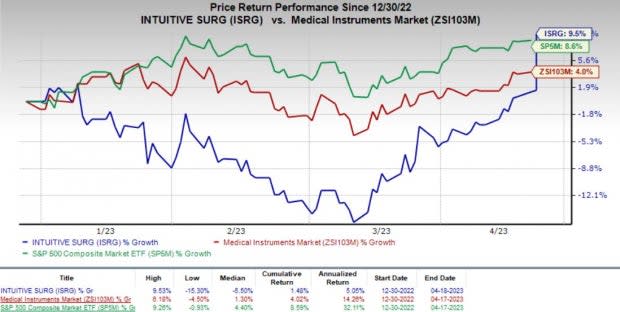

Shares of Intuitive Surgical gained 7.7% during after-hours trading on Apr 18, following encouraging first-quarter earnings results. The company’s shares are up 9.5% so far this year compared with a 4% improvement for the industry and an 8.6% increase for the S&P 500 Index.

Image Source: Zacks Investment Research

The intense competition in the global MedTech space remains a concern.

Stocks to Consider

Some better-ranked stocks in the broader medical space are Masimo MASI, Avanos Medical AVNS and AMN Healthcare Services, Inc. AMN.

Masimo has an estimated growth rate of 12.7% for 2023. MASI’s earnings surpassed estimates in each of the trailing four quarters, the average beat being 9.02%. MASI sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Masimo has gained 29.8% compared with the industry’s 4% growth so far this year.

Avanos Medical, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 19.1% for the next year. AVNS’ earnings surpassed estimates in each of the trailing four quarters, the average beat being 11.01%.

Avanos Medical has gained 10.6% compared with the industry’s 4% growth so far this year.

AMN Healthcare, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed estimates in each of the trailing four quarters, the average beat being 10.95%.

AMN Healthcare has lost 17.2% compared with the industry’s 4.9% decline so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report