Intuit's (INTU) Q2 Earnings and Revenues Beat Estimates

Intuit INTU reported fiscal second-quarter 2023 non-GAAP earnings of $2.20 per share, beating the Zacks Consensus Estimate of $1.43 per share. The bottom line surged 42% from the year-ago quarter’s earnings of $1.55 per share.

Revenues of $3.04 billion surpassed the consensus mark of $2.9 billion and surged 13.8% year over year.

Quarter Details

Segment-wise, Small Business and Self-Employed Group revenues grew 20% year over year to $1.9 billion. This rise was driven by the solid growth in customers for QuickBooks Online, a favorable mix-shift and the addition of Mailchimp.

Total Online Ecosystem revenues grew 24% year over year to $1.4 billion. QuickBooks Online Accounting revenues were up 27% year over year to $696 million, mainly driven by the mix-shift, higher pricing and customer growth.

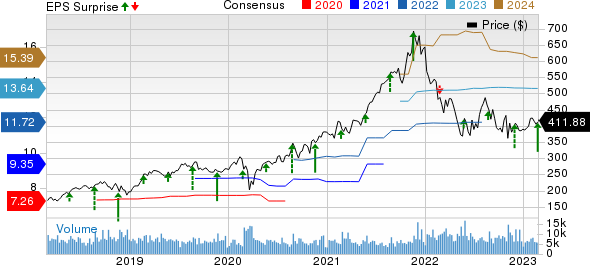

Intuit Inc. Price, Consensus and EPS Surprise

Intuit Inc. price-consensus-eps-surprise-chart | Intuit Inc. Quote

Online Services revenues which include payroll, payments, time tracking and capital, grew 21% year over year to $695 million. This was driven by strong performances of the QuickBooks Online payroll and QuickBooks Online payments solutions, along with revenues from the new Mailchimp business.

Within QuickBooks Online payroll, a mix-shift to INTU’s full-service offering and the continued uptick in the customer base acted as tailwinds. Within QuickBooks Online payments, an increase in the charge volume per customer and ongoing customer growth drove revenues. Mailchimp’s contribution was in up low teens in the quarter.

Total international Online Ecosystem revenues increased 17% year over year on a constant-currency basis.

Total Desktop ecosystem revenues grew 10% year over year during the reported quarter to $506 million.

In the fiscal second quarter, revenues from Consumer Group increased to $516 million from $411 million reported a year ago, mainly driven by a strong peak in new customers and extension filers. Further, ProTax Group's professional tax revenues increased to $253 million from $237 million in the year-ago quarter.

The Credit Karma business contributed $375 million to Intuit’s second-quarter total revenues, down from $444 million in the year-ago quarter. The drastic year-over-year fall reflects headwinds in personal loans, home loans, auto insurance and auto loans, partially offset by strength in credit cards and Credit Karma Money.

Intuit’s non-GAAP operating income climbed 40% to $856 million.

Balance Sheet and Cash Flow

As of Jan 31, 2023, Intuit’s cash and investments were $2.07 billion compared with $2.72 billion as of Oct 31, 2022.

The company exited the fiscal second quarter with long-term debt of $6.58 billion, up from the previous quarter’s $6.49 billion.

During the first six months of fiscal 2023, the company generated $612 million worth of cash from operating activities.

Intuit repurchased stocks worth $500 million during the fiscal second quarter and had a remaining share-repurchase authorization of $2.5 billion at the end of the quarter. INTU announced that its board approved a quarterly cash dividend of 78 cents per share payable on Apr 18, 2023. The newly approved cash dividend represents a year-over-year increase of 15%.

Outlook

Intuit projects fiscal 2023 revenues in the band of $14.035-$14.250 billion, indicating 10-12% growth.

The company anticipates non-GAAP operating income between $5.258 billion and $5.363 billion, indicating approximate year-over-year growth of 17-19%.

Intuit’s fiscal 2023 non-GAAP earnings per share forecast stands between $13.59 and $13.89, suggesting a year-over-year increase of 15-17%.

For the fiscal third quarter, INTU expects revenues to grow between 8% and 9% on a year-over-year basis. Adjusted earnings for the quarter are estimated in the range of $8.42-$8.49 per share.

Zacks Rank & Key Picks

Intuit carries a Zacks Rank #3 (Hold). Shares of INTU have lost 15.5% over the past year.

Some top-ranked stocks from the broader Computer and Technology sector are Airbnb ABNB, Baidu BIDU, and Fabrinet FN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Airbnb’s first-quarter 2023 earnings has been revised northward from breakeven to 14 cents per share over the past seven days. For 2023, earnings estimates have moved up by 52 cents to $3.38 per share in the past seven days.

ABNB's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 57.2%. Shares of the company have declined 19.1% in the past year.

The Zacks Consensus Estimate for Baidu’s fourth-quarter 2022 earnings has been revised 49 cents southward to $2.14 per share over the past 30 days. For 2022, earnings estimates have dropped by 3.4% to $8.64 per share over the past 30 days.

BIDU’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 50.2%. Shares of the company have lost 9.9% in the past year.

The Zacks Consensus Estimate for Fabrinet's third-quarter fiscal 2023 earnings has been revised 7 cents upward to $1.90 per share over the past 30 days. For fiscal 2023, earnings estimates have moved north by 24 cents to $7.71 per share in the past 30 days.

FN’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, missing once, the average surprise being 5.1%. Shares of the company have jumped 21.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report