Intuit's (NASDAQ:INTU) Q2 Earnings Results: Revenue In Line With Expectations

Tax and accounting software provider, Intuit (NASDAQ:INTU) reported results in line with analysts' expectations in Q2 FY2024, with revenue up 11.3% year on year to $3.39 billion. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $16 billion at the midpoint. It made a non-GAAP profit of $2.63 per share, improving from its profit of $2.20 per share in the same quarter last year.

Is now the time to buy Intuit? Find out by accessing our full research report, it's free.

Intuit (INTU) Q2 FY2024 Highlights:

Revenue: $3.39 billion vs analyst estimates of $3.39 billion

EPS (non-GAAP): $2.63 vs analyst estimates of $2.31 (13.9% beat)

The company reconfirmed its revenue guidance for the full year of $16 billion at the midpoint

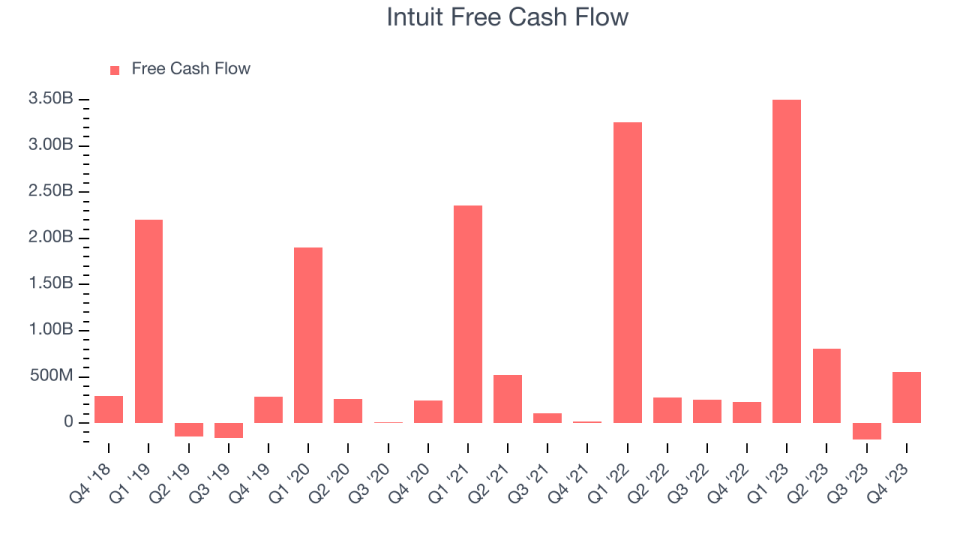

Free Cash Flow of $550 million is up from -$181 million in the previous quarter

Gross Margin (GAAP): 75.8%, in line with the same quarter last year

Market Capitalization: $178.7 billion

“We had another strong quarter as consumers and small businesses continue to rely on Intuit’s platform to power their prosperity,” said Sasan Goodarzi, Intuit's chief executive officer.

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Tax Software

The demand for easy to use, integrated cloud based finance software that integrates tax and accounting operations continues to rise in tandem with the difficulty workers find trying to use existing accounting tools like spreadsheets given the growing volume of finance data littered across a multitude of enterprise applications. A related demand driver is the secular increase of e-commerce and rising adoption of modern point of sales and payments platforms which easily integrate with backend financial software.

Sales Growth

As you can see below, Intuit's revenue growth has been mediocre over the last two years, growing from $2.67 billion in Q2 FY2022 to $3.39 billion this quarter.

This quarter its quarterly revenue was still up 11.3% year on year. We can see that Intuit's revenue increased by $408 million quarter on quarter, which is a solid improvement from the $266 million increase in Q1 2024. Shareholders should applaud the re-acceleration of growth.

Looking ahead, analysts covering the company were expecting sales to grow 11.8% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Intuit's free cash flow came in at $550 million in Q2, up 140% year on year.

Intuit has generated $4.68 billion in free cash flow over the last 12 months, an eye-popping 31% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Intuit's Q2 Results

This was mostly an in-line quarter for Intuit. EPS beat was a positive, while revenue guidance on the lower side of analyst expectations was the weaker part of the report. The company is down 1.9% on the results and currently trades at $645 per share.

Intuit may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.