The Invesco DWA Industrials Momentum ETF Continues its Poor Performance

The US industrial sector has performed well so far this year as the Biden administration is set to spend big on infrastructure.

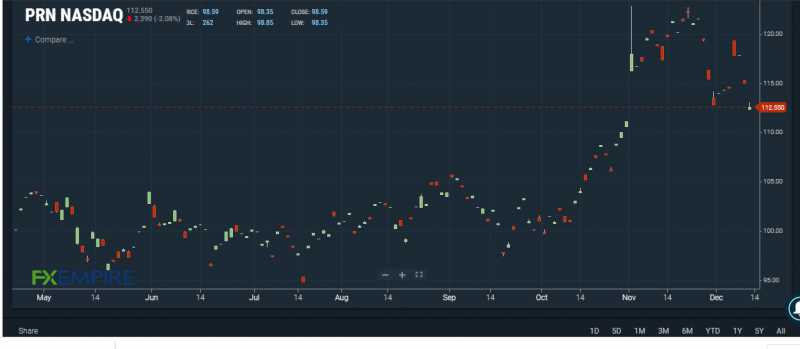

PRN has Underperformed in Recent Weeks

The Invesco DWA Industrials Momentum ETF (PRN) has underperformed over the past few weeks. The ETF has lost more than 6% of its value over the past month despite rallying since the start of the year. At press time, PRN is trading at $112.55, down by 1.95% over the past 24 hours.

The Invesco DWA Industrials Momentum ETF is a passively managed exchange-traded fund that has been around since 2006. The fund is sponsored by Invesco and currently has more than $250 million in assets under management, making it one of the average-sized ETFs attempting to match the performance of the Industrials – Broad segment of the US stock market.

The fund seeks to match the performance of the DWA Industrials Technical Leaders Index before fees and expenses. Meanwhile, the DWA Industrials Technical Leaders Index tracks the performance of companies with relative strength. It comprises 30 common stocks from a universe of approximately 3,000 common stocks traded on US exchanges.

PRN Remains a Good ETF

Despite its poor performance in recent weeks, PRN remains one of the top ETFs in its space. PRN currently has an annual operating expense of 0.60%, similar to most products in the space. The fund also has a 12-month trailing dividend yield of 0.07%.

The fund has the heaviest allocation in the Industrials sector, with 91.30% of the portfolio covering that sector. PRN has a beta of 1.07 and a standard deviation of 27.94% for the past three-year period, making it a medium-risk choice in the sector.

Since the start of the year, PRN has added more than 21% to its value, making it one of the top performers in the industrial sector. Despite its recent performance, PRN could still rally higher and touch the $120 mark over the coming weeks.

Heading into the holidays, the fund might likely remain around the $110-$115 level as investors take time off to look at the following year.

This article was originally posted on FX Empire