Invesco EQV European Equity Fund Bolsters Position in CRH PLC with a 1.94% Portfolio Stake

Insightful 13F Filing Update: Invesco Fund's Latest European Equity Moves

Invesco EQV European Equity Fund (Trades, Portfolio), known for its strategic investments in high-growth European markets, has revealed its N-PORT filing for the fourth quarter of 2023. The fund, which launched on November 3, 1997, seeks to capitalize on reasonably priced, quality companies across Europe, focusing on strong fundamentals and sustainable earnings growth. This recent filing sheds light on the fund's latest investment decisions, providing valuable insights for value investors.

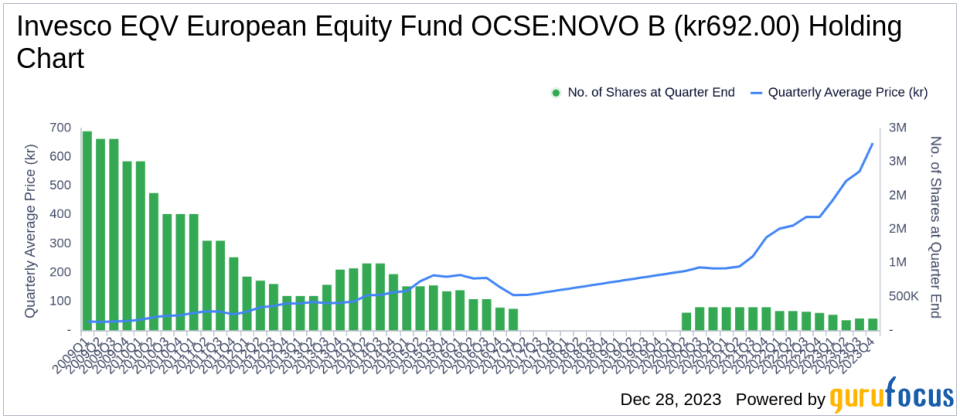

Warning! GuruFocus has detected 6 Warning Sign with OCSE:NOVO B.

Summary of New Buys

Invesco EQV European Equity Fund (Trades, Portfolio) expanded its portfolio with the addition of 3 new stocks. Noteworthy new positions include:

CRH PLC (LSE:CRH), with 153,899 shares, making up 1.94% of the portfolio and valued at 8.31 million.

BAE Systems PLC (LSE:BA.), comprising 381,118 shares, which is approximately 1.19% of the portfolio, with a total value of 5.12 million.

Compagnie Financiere Richemont SA (XSWX:CFR), with 40,088 shares, accounting for 1.1% of the portfolio and a total value of CHF 4.73 million.

Key Position Increases

The fund also bolstered its stakes in 6 existing holdings, with significant increases in:

Nestle SA (XSWX:NESN), adding 27,367 shares to reach a total of 139,451 shares. This represents a 24.42% increase in share count, impacting the portfolio by 0.69%, and a total value of CHF 15.04 million.

Kingspan Group PLC (DUB:KRX), with an additional 42,724 shares, bringing the total to 64,974 shares. This adjustment marks a 192.02% increase in share count, with a total value of 4.37 million.

Summary of Sold Out Positions

The fund completely exited 5 holdings in the fourth quarter of 2023, including:

CRH PLC (DUB:CRG), selling all 137,579 shares, which had a -1.63% impact on the portfolio.

SBM Offshore NV (XAMS:SBMO), liquidating all 555,382 shares, causing a -1.59% impact on the portfolio.

Key Position Reductions

Moreover, Invesco EQV European Equity Fund (Trades, Portfolio) reduced its position in 42 stocks. The most significant reductions were:

DCC PLC (LSE:DCC), by 63,484 shares, resulting in a -22.9% decrease in shares and a -0.73% impact on the portfolio. The stock traded at an average price of 44.52 during the quarter and has returned 28.02% over the past 3 months and 46.70% year-to-date.

Amadeus IT Group SA (XMAD:AMS), by 38,326 shares, leading to a -25.02% reduction in shares and a -0.54% impact on the portfolio. The stock traded at an average price of 59.95 during the quarter and has returned 12.89% over the past 3 months and 35.36% year-to-date.

Portfolio Overview

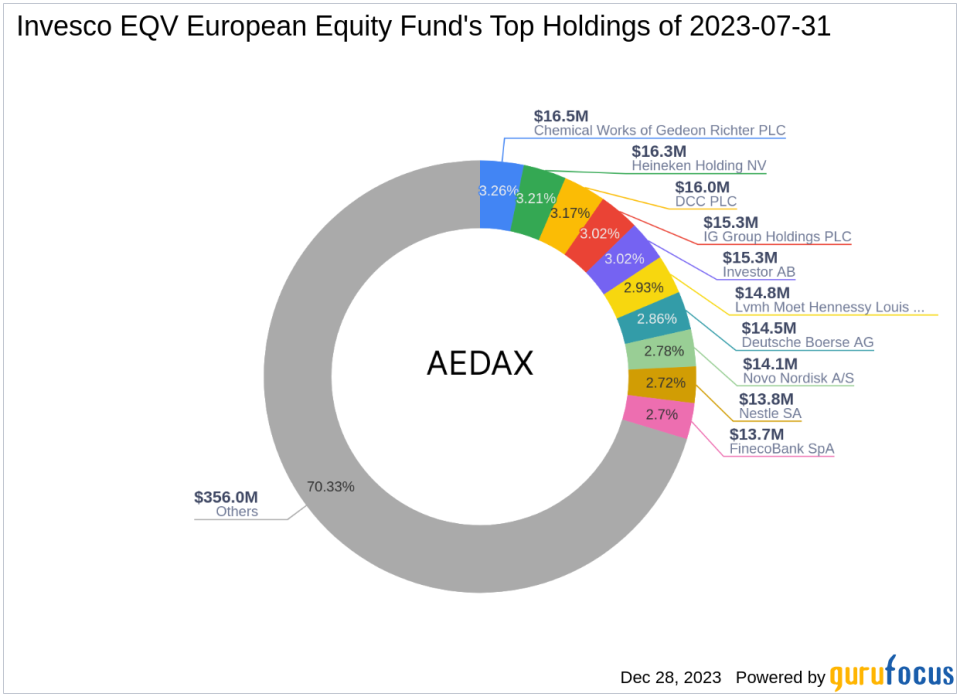

As of the fourth quarter of 2023, Invesco EQV European Equity Fund (Trades, Portfolio)'s portfolio comprised 51 stocks. The top holdings included 3.89% in Novo Nordisk A/S (OCSE:NOVO B), 3.51% in Nestle SA (XSWX:NESN), 3.49% in Heineken Holding NV (XAMS:HEIO), 3.29% in Chemical Works of Gedeon Richter PLC (BUD:RICHTER), and 3.23% in RELX PLC (LSE:REL). The fund's investments are primarily concentrated across 10 industries, including Industrials, Healthcare, Financial Services, Consumer Defensive, Consumer Cyclical, Energy, Communication Services, Basic Materials, Technology, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.