Invesco Ltd (IVZ) Reports Mixed Fourth Quarter Amidst Market Challenges

Net Long-Term Inflows: IVZ reported $6.7 billion in net long-term inflows for Q4, with ETFs contributing significantly.

Assets Under Management (AUM): Ending AUM reached $1,585.3 billion, marking a 6.6% increase from the previous quarter.

Adjusted Operating Margin: Despite a non-cash intangible asset impairment, adjusted operating margin remained unaffected at 26.3%.

Adjusted Diluted EPS: IVZ announced an adjusted diluted EPS of $0.47, excluding the impact of the intangible impairment.

Debt Position: Net debt reduced to $20.3 million with a strong cash position of $1.5 billion in cash and cash equivalents.

Dividend Announcement: A fourth quarter cash dividend of $0.20 per share has been declared for common shareholders.

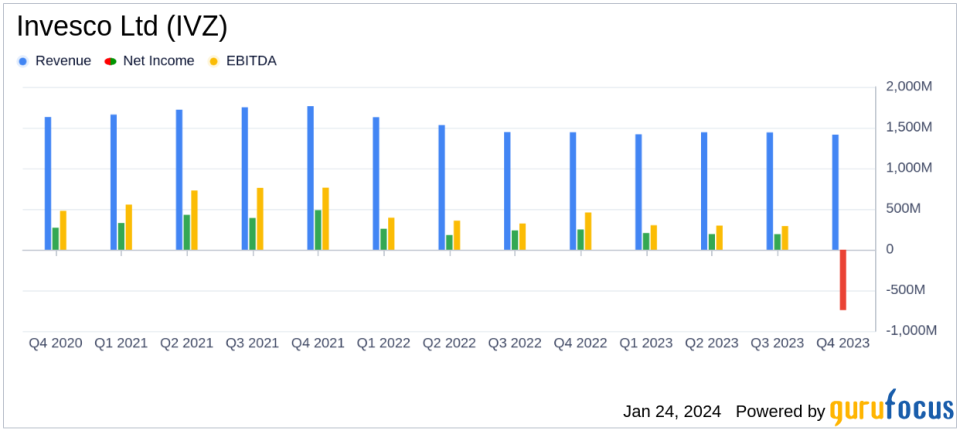

Invesco Ltd (NYSE:IVZ) released its 8-K filing on January 23, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The global investment management firm, which provides services to retail and institutional clients, reported a diluted EPS of $(1.64) for the quarter, significantly impacted by an intangible impairment of $1.2 billion. However, when adjusted for this impairment, the diluted EPS stood at $0.47. Invesco's AUM increased by 12.5% year-over-year, reflecting the firm's resilience in a challenging market environment.

Invesco, known for its diverse range of investment capabilities, including equity, fixed-income, and alternative investments, faced a challenging quarter with a substantial non-cash intangible asset impairment. However, the firm's net long-term inflows, particularly from ETFs, active fixed income, and private markets, highlight its competitive position and ability to attract investment despite market volatility. The firm's disciplined approach to expense management and investment in high-demand solutions has been crucial in navigating the industry's emerging trends.

Financial Performance and Challenges

IVZ's operating margin for Q4 2023 was significantly affected by the intangible asset impairment, resulting in a (76.1)% operating margin. However, the adjusted operating margin, which excludes this impairment, was reported at 26.3%. The firm's net debt position improved, ending the year at $20.3 million, down from $247.6 million at the end of the previous quarter. This reduction in net debt, coupled with a strong cash position, underscores Invesco's solid financial footing and ability to manage its balance sheet effectively.

Despite the impairment, Invesco's net long-term inflows and AUM growth are indicative of its underlying strength. The firm's global ETF platform saw 17% organic growth, and its geographic positioning allowed it to capture inflows in various market cycles. Invesco's President and CEO, Andrew Schlossberg, commented on the firm's performance:

"Organic flow growth outperformed in the fourth quarter and the year during a challenging environment for organic asset growth in 2023... This performance demonstrates the strength of the firms market position and our ability to leverage the breadth of our platform to meet client needs in various cycles."

Looking Ahead

As Invesco enters 2024, the firm is well-positioned to assist clients with evolving market dynamics and portfolio adjustments. The focus on profitable growth and a simplified organizational structure is expected to translate into improved scale, performance, and profitability. The firm's commitment to investment excellence and client service remains a cornerstone of its strategy moving forward.

In conclusion, Invesco's fourth quarter was marked by significant challenges, particularly the non-cash intangible asset impairment. However, the firm's strong net inflows, AUM growth, and disciplined financial management paint a picture of resilience. Investors and stakeholders can take solace in Invesco's robust balance sheet and strategic positioning as it continues to navigate the complexities of the asset management industry.

Explore the complete 8-K earnings release (here) from Invesco Ltd for further details.

This article first appeared on GuruFocus.