If You Invested $1,000 in T-Mobile US 10 Years Ago, This Is How Much You Would Have Today

A decade ago, T-Mobile US (NASDAQ: TMUS) had just closed its $1.5 billion all-cash buyout of the Metro PCS prepaid service provider. Its first attempt to merge with Sprint was just around the corner, and the game-changing series of "Uncarrier" policies was in full swing.

Big Magenta has come a long way from that crossroads. What if you saw long-term promise in the unconventional telecom carrier back then, invested a cool $1,000, and held on tight until February 2024?

Let's have a look.

Charting the 10-year return

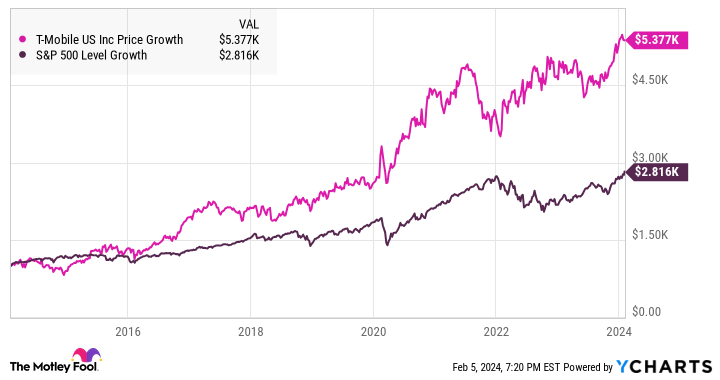

A picture speaks a whole bunch of words, so let's start there. Here's how that hypothetical $1,000 investment in T-Mobile would have played out over the last decade, compared to a similar bet on the S&P 500 market index:

Your $1,000 T-Mobile stake would be worth roughly $5,400 today, compared to $2,820 if you simply tracked the broader market instead.

As it turns out, that T-Mobile bet also outpaced investments in its chief competitors by a mile-wide margin. An investment of $1,000 in Verizon Communications stock in 2014 would be worth just $883 today, and an AT&T bet of the same size would have dwindled to $724.

Dividends -- the great equalizer?

But wait. Ma Bell and Big Red always offer generous dividend yields. So do exchange-traded funds (ETFs) matching the S&P 500, such as the Vanguard S&P 500 ETF. But T-Mobile only started sending out dividend checks two quarters ago and its forward-looking annual yield is just 1.6%.

Did those robust payouts change the game for AT&T and Verizon investors? Let's see what a four-way chart looks like with dividend reinvestments enabled for everybody:

The two larger telecoms managed to grow your money with reinvested dividends along the way, but the short answer is still a clear "no." Their dividend-boosted annual returns still only averaged approximately 4%.

The S&P 500 fund came closer this time with a final tally of $3,400, but T-Mobile's unchanged return is still the king of the telecom hill at $5,400. That's a compound average growth rate of 18.4% per year.

Big Magenta is my favorite telecom idea today, too

Ten years ago, investing in T-Mobile was akin to choosing the underdog in a telecom tug-of-war. Fast-forward to today, and it's clear that Big Magenta wasn't just barking up the right tree -- it was replanting the whole forest. The former telecom duopoly is now a pretty balanced competitive scene with robust pillars of red, blue, and magenta.

While Verizon and AT&T were busy counting pennies for their dividend checks, T-Mobile merged with Sprint in a $26 billion stock-swap deal to rebalance the wireless phone industry. It never stopped pushing the envelope with innovative sales tactics and consumer-friendly prices. Sometimes, the best dividends are those of daring and innovation.

In the long run, betting on the company that's disrupting an overly conservative industry can send you laughing all the way to the bank. In T-Mobile's case, it's money in your pocket. The next 10 years may not be as game-changingly successful, but T-Mobile is still the only American telecom stock I would recommend today.

Should you invest $1,000 in T-Mobile US right now?

Before you buy stock in T-Mobile US, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and T-Mobile US wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 5, 2024

Anders Bylund has positions in T-Mobile US and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

If You Invested $1,000 in T-Mobile US 10 Years Ago, This Is How Much You Would Have Today was originally published by The Motley Fool