Investing in Carrols Restaurant Group (NASDAQ:TAST) a year ago would have delivered you a 314% gain

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. While not every stock performs well, when investors win, they can win big. For example, the Carrols Restaurant Group, Inc. (NASDAQ:TAST) share price is up a whopping 313% in the last 1 year, a handsome return in a single year. On top of that, the share price is up 50% in about a quarter. However, the longer term returns haven't been so impressive, with the stock up just 22% in the last three years.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Carrols Restaurant Group

We don't think that Carrols Restaurant Group's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Carrols Restaurant Group grew its revenue by 8.8% last year. That's not a very high growth rate considering it doesn't make profits. So it's truly surprising that the share price rocketed 313% in a single year. It's great to see that some have made big profits, but we aren't so sure that the increase is justified. It just goes to show that big money can be made if you buy the right stock early.

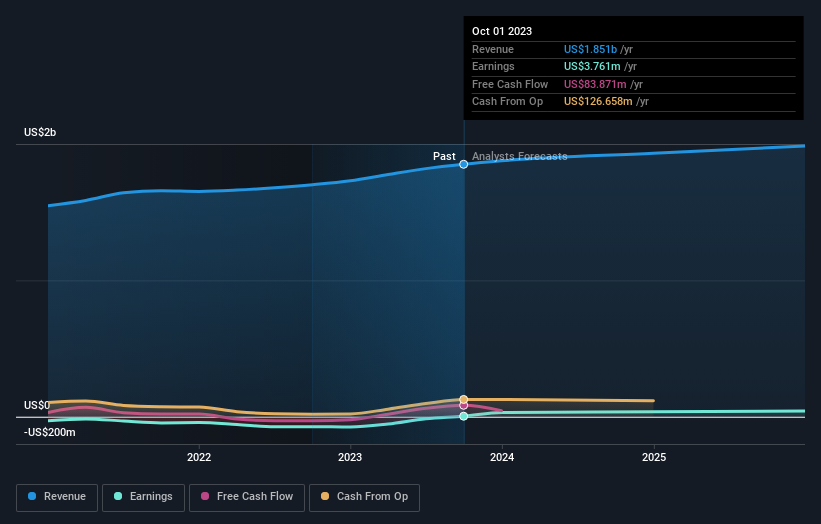

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Carrols Restaurant Group

A Different Perspective

We're pleased to report that Carrols Restaurant Group shareholders have received a total shareholder return of 314% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 1.4%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Carrols Restaurant Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Carrols Restaurant Group (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.