Investing With Elliott: A Look at Crown Castle's Attractive Dividend Yield, Undervaluation

Crown Castle Inc. (NYSE:CCI) has experienced a significant decline in its market value over the past two years, witnessing a nearly 50% drop. From its peak at almost $209 in December 2021, the share price has plunged to just $104.

Elliott Investment Management has recently accumulated a substantial stake in the company valued at over $2 billion, signaling its intent to advocate for transformative changes. It appears that Elliott recognizes considerable growth prospects for Crown Castle through a potential restructuring effort.

Tower business with long-term tenants

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

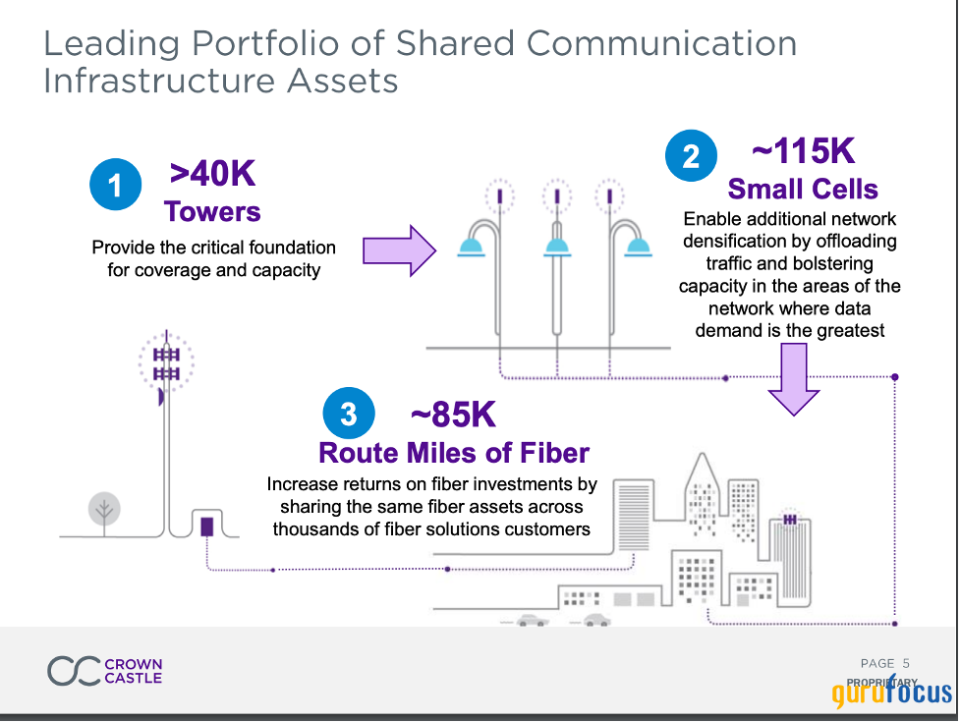

A leading communication infrastructure real estate investment trust, Crown Castle has an extensive portfolio with over 40,000 towers, approximately 115,000 small cells secured through contracts and an impressive 85,000 miles of fiber routes.

Source: Crown Castle's presentation

Crown Castle's three biggest tenants, T-Mobile (NASDAQ:TMUS), AT&T (NYSE:T) and Verizon (NYSE:VZ), collectively contributed to approximately 73% of its total revenue. The company operates through two primary business segments: Towers and Fiber. It earns monthly rental income within the Towers segment by leasing towers to wireless carriers for network deployment. The Fiber segment offers small cells for data offloading and provides fiber solutions to bolster network capacity and connectivity for wireless carriers and organizations with high bandwidth and multi-location requirements.

Most of Crown Castle's contracts are long-term in nature. As of 2022, the average remaining contract life for land under the company's towers is 36 years. Additionally, most tenants engage in long-term contracts with initial terms spanning from five to 15 years, which can be renewed for multiple periods of five to 10 years each. This extended contractual relationship contributes to a high tenant retention rate at around 98% to 99%. The enduring nature of these contracts ensures tower operators like Crown Castle can generate a steady and recurring long-term revenue and cash flow stream.

Low interest and long-duration debt with strong free cash flow growth

The tower industry often requires significant capital investment, but generates steady revenue and cash flow. Thus, many businesses in this sector use substantial leverage. Crown Castle's financials reflect this trend. As of September, the company had $21.9 billion in real estate assets and $10.1 billion in goodwill. Its equity stood at $6.67 billion, while it carried short and long-term debt of $22.5 billion and $5.9 billion in capital leases.

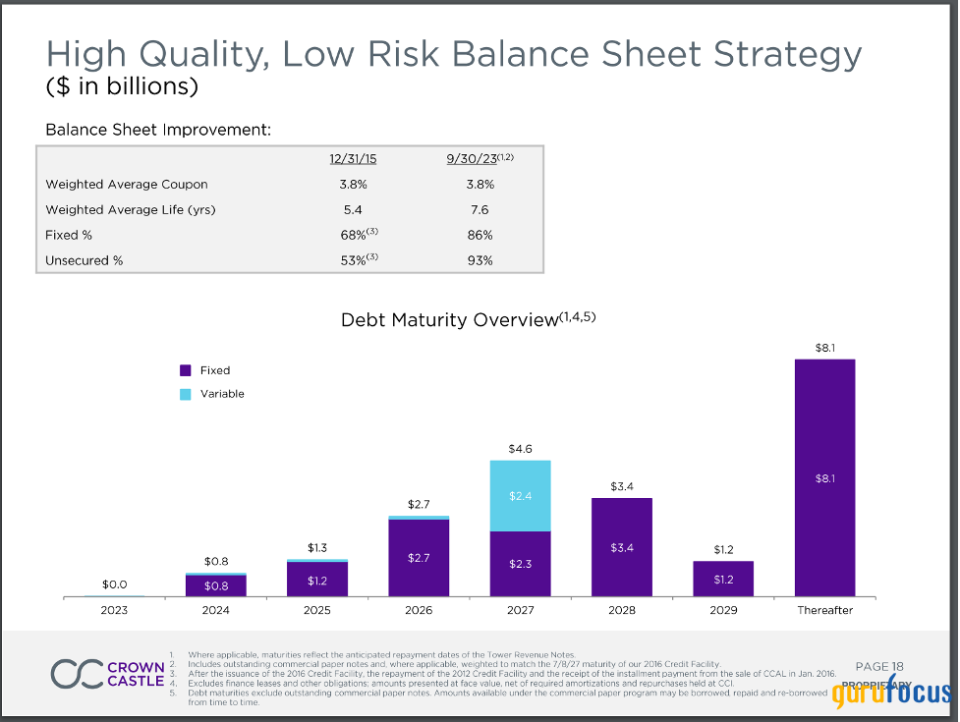

Crown Castle has capitalized on the favorable conditions of low interest rates and extended durations to boost growth through its current operations and strategic acquisitions. The company's weighted average coupon rate stands at a modest 3.8%. A significant portion, 86%, of its total debt, comprises fixed-rate loans, enhancing financial stability, while 93% are unsecured, offering greater flexibility. Moreover, the weighted average remaining term of this debt is 7.6 years. This combination of low-interest, fixed-rate loans with a long maturity period grants Crown Castle considerable flexibility to invest and expand its business effectively.

Source: Crown Castle's presentation

Crown Castle's adjusted Ebitda for 2023 was projected to be $4.4 billion, resulting in a net leverage ratio of 5 times. Historically, Crown Castle has maintained a net debt/Ebitda ratio between 5.4 and 7.5 over the past decade, indicating a gradual deleveraging, primarily driven by growth in cash flow. In 2012, the company's Ebitda was $1.49 billion, which grew to $4.12 billion by 2022. For 2023, it was expected to reach $4.4 billion. Over the past 11 years, Crown Castle's Ebitda has shown an average compounded annual growth rate of 10.3%.

Currently undervalued

The company's stock market multiples have shown significant fluctuations. Since 2006, the Ebitda multiples ranged from 11.23 to 35.7, influenced by economic and market conditions, averaging around 22.3 times enterprise value/Ebitda over these 17 years. In 2024, Crown Castle's adjusted Ebitda is anticipated to fall by 6% to $4.16 billion and its adjusted funds from operations by 8% to $3 billion, mainly due to nonrecurring Sprint cancellations. With an expected Ebitda of $4.16 billion in 2024 and a 20 times multiple, the company's valuation could reach approximately $83.2 billion.

With net debt of $23 billion, Crown Castle's intrinsic value is estimated at around $60 billion. A total of 433.7 million shares outstanding translates to a share price of about $138, 33% higher than the current price.

As a REIT, the company typically pays out roughly 80% of its cash flow in the form of dividends. The company plans to continue its annual dividend of $6.26 per share. At the current share price of $103.6, this dividend yields an attractive 6%.

Conclusion

With the recent plunge in market value, Crown Castle presents a unique opportunity for investors, especially considering its juicy dividend yield and decent undervaluation. The company's robust infrastructure network and long-term contracts provide a stable foundation, while the strategic involvement of Elliott Investment Management could catalyze transformative growth. Its resilience in managing its debt and maintaining steady cash flow growth further underscores its potential.

This article first appeared on GuruFocus.