Investing in Sensient Technologies (SXT): Navigating the Thin Line Between Value and Trap

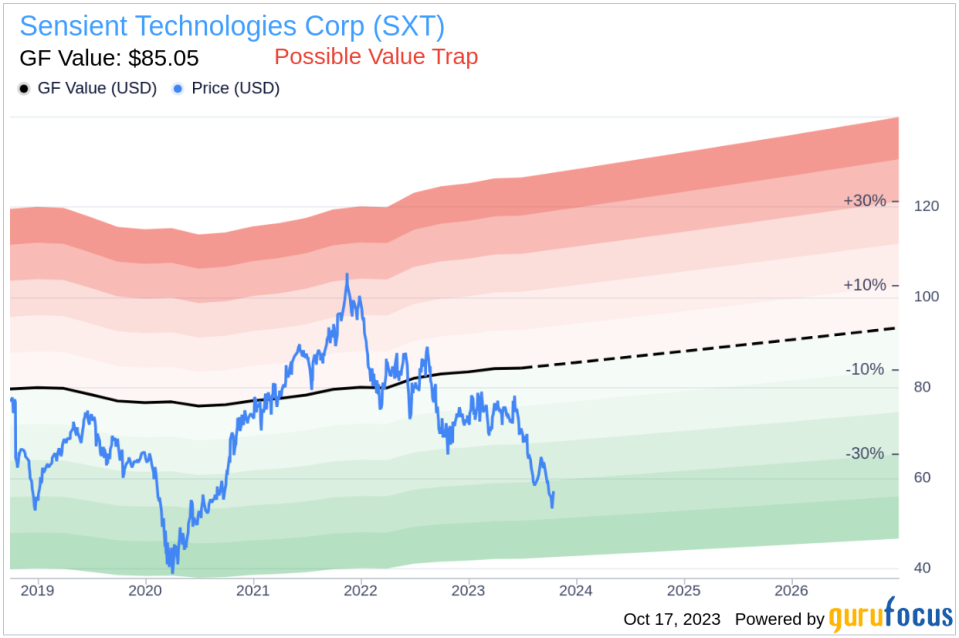

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is Sensient Technologies Corp (NYSE:SXT). The stock, which is currently priced at $56.86, recorded a gain of 6.48% in a day and a 3-month decrease of 15.64%. The stock's fair valuation is $85.05, as indicated by its GF Value.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock derived from an exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors:

Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

The GF Value Line is believed to be the fair value that the stock should be traded at. The stock price will most likely fluctuate around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

Identifying the Risks

However, investors need to consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with Sensient Technologies should not be ignored. These risks are primarily reflected through its low Piotroski F-score and high Beneish M-score. These indicators suggest that Sensient Technologies, despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

Company Snapshot

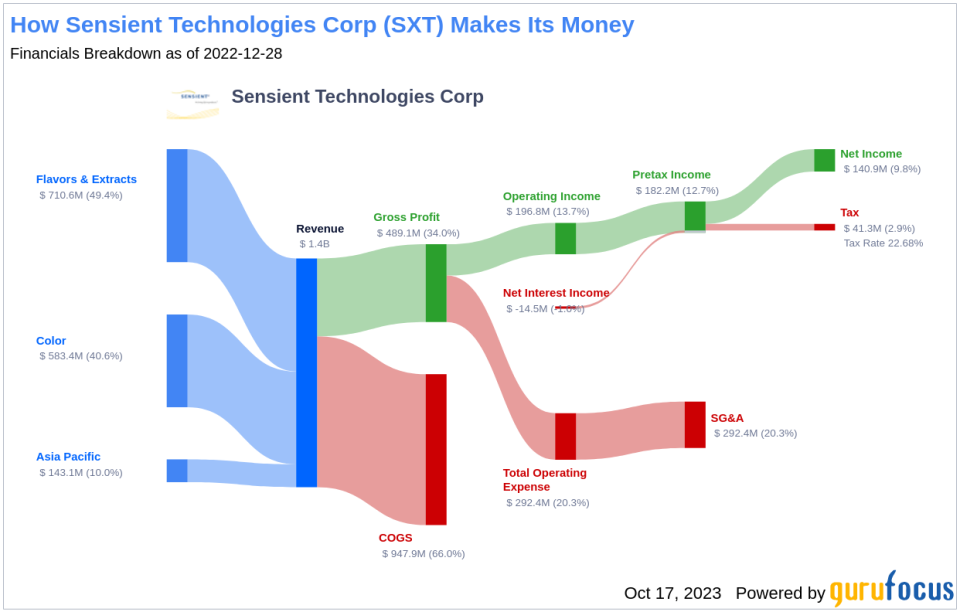

Sensient Technologies Corp manufactures and markets natural and synthetic colors, flavors, and other specialty ingredients. The company has a widespread network of facilities around the globe, and its customers operate across a variety of end markets. Sensient's offerings are predominantly applied to consumer-facing products, including food and beverage, cosmetics and pharmaceuticals, nutraceutical and personal care industries.

Conclusion: A Value Trap?

Given the company's low Piotroski F-score and high Beneish M-score, investors should exercise caution. Despite Sensient Technologies' seemingly attractive valuation, these indicators suggest that it may be a potential value trap. Investors must, therefore, conduct thorough due diligence before making an investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.