Investing in Spero Therapeutics (NASDAQ:SPRO) three years ago would have delivered you a 28% gain

It might be of some concern to shareholders to see the Spero Therapeutics, Inc. (NASDAQ:SPRO) share price down 10% in the last month. But at least the stock is up over the last three years. In that time, it is up 28%, which isn't bad, but not amazing either.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Spero Therapeutics

Given that Spero Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

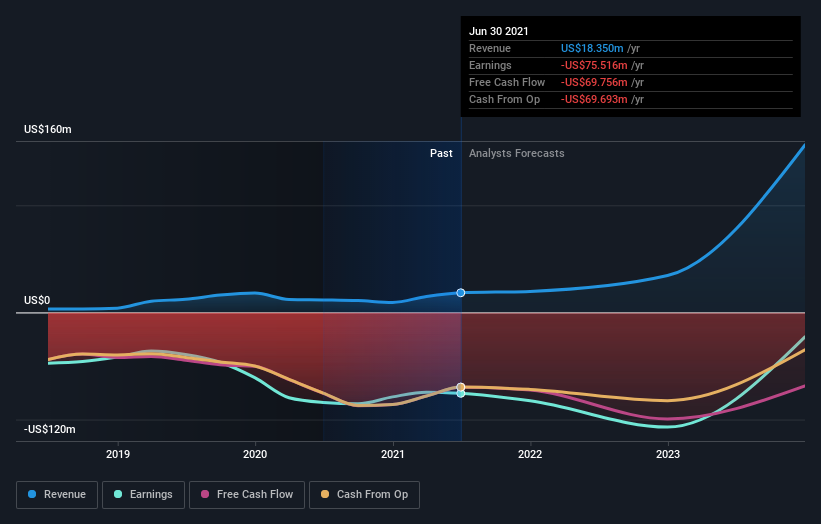

Spero Therapeutics' revenue trended up 33% each year over three years. That's well above most pre-profit companies. The stock is up 9% over that time - a decent but not impressive return. We would have thought the top-line growth might have impressed buyers more. It could be that the stock was previously over-priced, or its losses might worry the market. But you might want to take a closer look at this one.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Spero Therapeutics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Spero Therapeutics shareholders are up 7.4% for the year. Unfortunately this falls short of the market return of around 36%. At least the longer term returns (running at about 9% a year, are better. We prefer focus on longer term returns, as they are usually a more meaningful indication of the underlying business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Spero Therapeutics .

Of course Spero Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.