Investment Guru Larry Robbins' Q2 2023 Portfolio Update

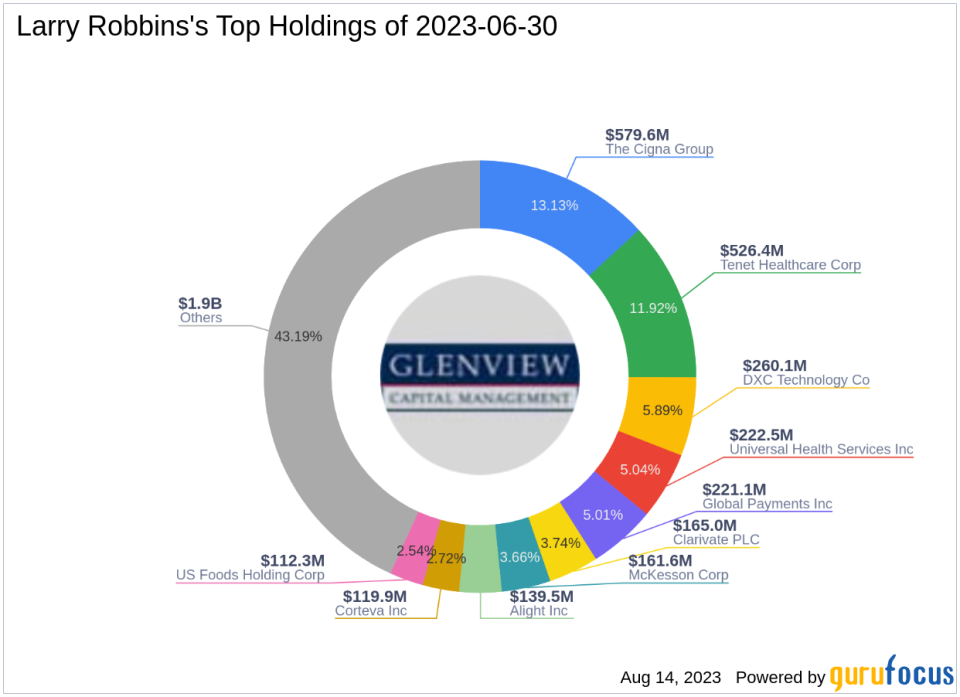

Renowned investment guru Larry Robbins recently disclosed his firm's portfolio for the second quarter of 2023, which ended on June 30, 2023. Robbins is known for his strategic investment approach, focusing on undervalued stocks with strong growth potential. His firm's portfolio for Q2 2023 comprised 48 stocks, with a total value of $4.42 billion.

The top holdings in Robbins' portfolio were CI (13.13%), THC (11.92%), and DXC (5.89%).

Top Three Trades of the Quarter

Robbins' top three trades for the quarter involved Fiserv Inc, McKesson Corp, and Universal Health Services Inc.

Fiserv Inc (NYSE:FI)

Robbins reduced his firm's investment in Fiserv Inc by 1,269,730 shares, impacting the equity portfolio by 3.16%. The stock traded at an average price of $117.65 during the quarter. As of August 14, 2023, Fiserv's stock price was $124.47, with a market cap of $75.88 billion. The stock has returned 13.84% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 10 out of 10. In terms of valuation, Fiserv has a price-earnings ratio of 31.35, a price-book ratio of 2.56, a price-earnings-to-growth (PEG) ratio of 1.81, a EV-to-Ebitda ratio of 13.83 and a price-sales ratio of 4.27.

McKesson Corp (NYSE:MCK)

Robbins also reduced his firm's investment in McKesson Corp by 261,744 shares, impacting the equity portfolio by 2.05%. The stock traded at an average price of $383.91 during the quarter. As of August 14, 2023, McKesson's stock price was $438, with a market cap of $59.09 billion. The stock has returned 20.54% over the past year. GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 8 out of 10. In terms of valuation, McKesson has a price-earnings ratio of 16.34, a EV-to-Ebitda ratio of 11.49 and a price-sales ratio of 0.22.

Universal Health Services Inc (NYSE:UHS)

During the quarter, Robbins bought 548,422 shares of Universal Health Services Inc, bringing the total holding to 1,410,525 shares. This trade had a 1.96% impact on the equity portfolio. The stock traded at an average price of $139.28 during the quarter. As of August 14, 2023, Universal Health Services' stock price was $132.06, with a market cap of $9.16 billion. The stock has returned 18.57% over the past year. GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 9 out of 10. In terms of valuation, Universal Health Services has a price-earnings ratio of 13.71, a price-book ratio of 1.52, a price-earnings-to-growth (PEG) ratio of 2.59, a EV-to-Ebitda ratio of 8.62 and a price-sales ratio of 0.67.

In conclusion, Robbins' Q2 2023 portfolio reflects his firm's strategic investment approach, focusing on companies with strong growth potential and reasonable valuations. His top trades for the quarter provide valuable insights into his investment strategy and the sectors he is currently focusing on.

This article first appeared on GuruFocus.