Investments Craft PepsiCo's (PEP) Growth Story: Stock to Gain

PepsiCo Inc. PEP has been in a good spot, courtesy of strength and resilience in its categories, diversified portfolio, modernized supply chain, improved digital capabilities, flexible go-to-market distribution systems and robust consumer demand trends, which have been aiding its performance. Robust performances of the global beverage and convenient food businesses have been the key to the company’s growth story. Productivity and cost-saving plans also bode well.

PepsiCo continued its robust top and bottom-line surprise trend for the seventh consecutive quarter in third-quarter 2023. Sales and earnings also improved year over year. On an organic basis, revenues grew 8.8% year over year, driven by broad-based growth across categories and geographies.

PEP’s core constant-currency earnings improved 16% from the year-ago period, backed by strong top-line growth, as well as the mitigation of inflationary pressures through cost-management and revenue-management initiatives. The strong top line resulted from a robust price/mix in the reported quarter. Unit volume declined 1.5% year over year for the convenient food business and was flat year over year for the beverage business.

The Zacks Consensus Estimate for PEP’s current financial-year sales and earnings suggests growth of 6.4% and 11.2%, respectively, from the year-ago reported numbers.

However, PepsiCo has been witnessing cost pressures from the impacts of supply-chain disruptions; and inflationary labor, transportation and commodity costs. Adverse currency rates also act as headwinds.

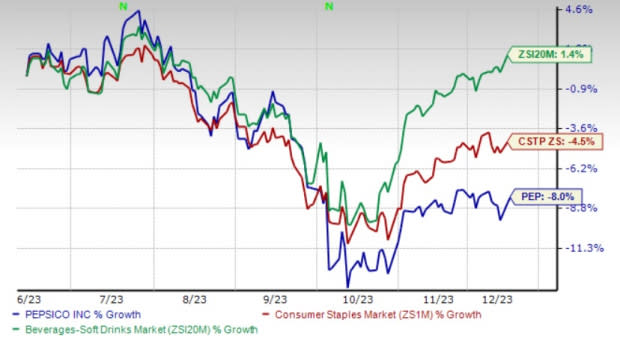

Shares of the Zacks Rank #2 (Buy) company have lost 8% in the past six months against the industry’s 1.4% growth. The stock also compared favorably with the Consumer Staples sector’s decline of 4.5%.

Image Source: Zacks Investment Research

What’s Working Well for PEP?

PepsiCo has been benefiting from continued investments in its brands, go-to-market systems, supply chains, manufacturing capacity and digital capabilities to build competitive advantages. Accelerated growth in the global beverage and convenient food businesses positions the company for improvement in the near term. This reflects the strength in its diversified portfolio.

The company has been a key beneficiary of its presence in the snacking and food category, along with its beverage profile. On a year-over-year basis, organic revenues grew 8% for the global beverage business and 9% for the convenient food business in the third quarter. Region-wise, organic revenues improved 7% and 12%, respectively, in North America and International businesses.

In the third quarter, Frito-Lay North America (FLNA) and Quaker Foods North America (QFNA) delivered organic revenue growth of 7% and 5%, respectively. Growth in FLNA was driven by its diversified portfolio, marketplace execution and robust pricing. The business continued to gain from strong category trends, as consumers prefer popular, trusted brands that offer value, convenience and variety. In QFNA, growth was driven by effective pricing actions and higher organic volumes.

PepsiCo has been continually focused on driving greater efficiency and effectiveness by driving down costs and plowing back these savings to develop scale and core capabilities. In 2019, the company delivered more than $1 billion in productivity savings, keeping it on track with its goal of generating productivity savings of at least $1 billion annually through 2023.

PEP expects to achieve this productivity goal through savings generated from restructuring actions. These actions are likely to position the company to further simplify, synchronize and automate processes; re-engineer the go-to-market and information systems; simplify the organization; and optimize its manufacturing and supply-chain footprint.

As part of these restructuring actions, the company estimates incurring pre-tax charges of $2.5 billion through 2023 (with a cash portion of $1.6 billion). Savings from the productivity and restructuring plans should go a long way in driving the top line and margins.

PepsiCo’s cost-management initiatives have been aiding margins in third-quarter 2023. On a consolidated basis, the reported gross margin expanded 140 basis points (bps), while the core gross margin expanded 104 bps in the third quarter. The reported operating margin expanded 186 bps from the year-ago quarter. Meanwhile, the core operating margin expanded 82 bps due to ongoing holistic cost-management initiatives to drive superior supply chain and distribution efficiencies, offset by a double-digit increase in advertising and marketing expenses.

PepsiCo raised its core EPS guidance for 2023. The company reaffirms its organic revenue growth prediction of 10% for 2023. It anticipates core constant-currency EPS growth of 13% from the year-ago period’s reported figure. PepsiCo expects a core EPS of $7.54 for 2023, suggesting an 11% increase from the core EPS of $6.79 reported in 2022.

PEP also outlined its initial view for 2024. It expects to deliver organic revenue and core constant currency EPS growth at the upper end of its long-term guidance ranges for 2024. The company earlier predicted organic revenue growth of 4-6% and core constant-currency EPS growth of high-single digits over the long term.

Other Stocks to Consider

Some other top-ranked stocks from the broader Consumer Staples space are Molson Coors TAP, The Duckhorn Portfolio NAPA and Fomento Economico Mexicano FMX.

Molson Coors, a global manufacturer and seller of beer and other beverage products, currently sports a Zacks Rank #1 (Strong Buy). Shares of TAP have declined 6% in the past six months. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Molson Coors’ current financial year’s sales and earnings per share suggests growth of 9.1% and 28.8%, respectively, from the year-ago period’s reported figures. TAP has a trailing four-quarter earnings surprise of 41.3%, on average.

Duckhorn Portfolio, a premier producer of wines, principally in North America, has a trailing four-quarter earnings surprise of 13.7%, on average. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Duckhorn Portfolio’s current financial-year sales suggests growth of 4.3% from the year-ago period's reported figure. Shares of NAPA have declined 33.1% in the past six months.

Fomento Economico Mexicano, alias FEMSA, participates in the beverage industry through Coca-Cola FEMSA, which is the world’s largest franchise bottler for Coca-Cola products. It currently carries a Zacks Rank #2. FMX shares have rallied 15.7% in the past six months.

The Zacks Consensus Estimate for FMX’s current financial-year sales and earnings suggests growth of 32.3% and 60.3%, respectively, from the year-ago period's reported figures. FMX has a trailing four-quarter earnings surprise of 23.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report