Investor Optimism Abounds Australian Agricultural Company Limited (ASX:AAC) But Growth Is Lacking

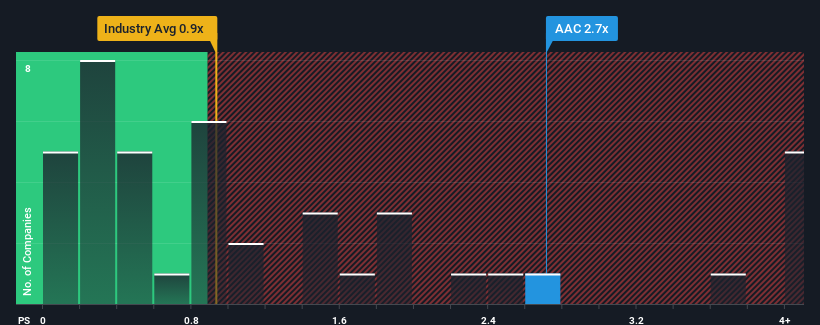

When you see that almost half of the companies in the Food industry in Australia have price-to-sales ratios (or "P/S") below 0.9x, Australian Agricultural Company Limited (ASX:AAC) looks to be giving off some sell signals with its 2.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Australian Agricultural

What Does Australian Agricultural's P/S Mean For Shareholders?

Australian Agricultural could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Australian Agricultural's future stacks up against the industry? In that case, our free report is a great place to start.

What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Australian Agricultural's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 6.9%. Revenue has also lifted 7.3% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 2.3% as estimated by the one analyst watching the company. With the industry predicted to deliver 6.1% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Australian Agricultural is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Australian Agricultural, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Australian Agricultural with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Australian Agricultural's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.