Investor Optimism Abounds Emerson Electric Co. (NYSE:EMR) But Growth Is Lacking

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

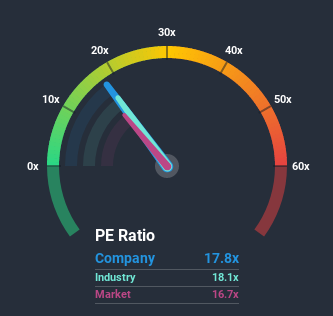

It's not a stretch to say that Emerson Electric Co.'s (NYSE:EMR) price-to-earnings (or "P/E") ratio of 17.8x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Emerson Electric's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Emerson Electric

Does Emerson Electric Have A Relatively High Or Low P/E For Its Industry?

We'd like to see if P/E's within Emerson Electric's industry might provide some colour around the company's fairly average P/E ratio. The image below shows that the Electrical industry as a whole also has a P/E ratio similar to the market. So this certainly goes a fair way towards explaining the company's ratio right now. Ordinarily, the majority of companies' P/E's would be constrained by the general conditions within the Electrical industry. Nonetheless, the greatest force on the company's P/E will be its own earnings growth expectations.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Emerson Electric.

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Emerson Electric would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.5%. Still, the latest three year period has seen an excellent 37% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 1.8% per annum as estimated by the analysts watching the company. With the market predicted to deliver 9.5% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Emerson Electric's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Emerson Electric's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for Emerson Electric that you need to take into consideration.

Of course, you might also be able to find a better stock than Emerson Electric. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.