Investor Optimism Abounds NeoGenomics, Inc. (NASDAQ:NEO) But Growth Is Lacking

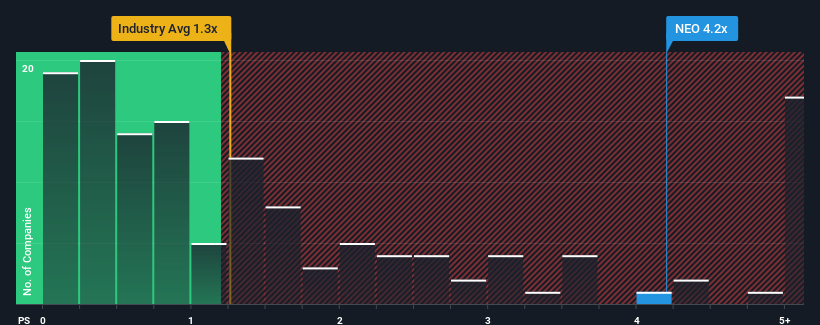

When close to half the companies in the Healthcare industry in the United States have price-to-sales ratios (or "P/S") below 1.3x, you may consider NeoGenomics, Inc. (NASDAQ:NEO) as a stock to avoid entirely with its 4.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for NeoGenomics

What Does NeoGenomics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, NeoGenomics has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on NeoGenomics will help you uncover what's on the horizon.

What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as NeoGenomics' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 9.0%. The solid recent performance means it was also able to grow revenue by 26% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 8.3% during the coming year according to the analysts following the company. With the industry predicted to deliver 8.7% growth , the company is positioned for a comparable revenue result.

In light of this, it's curious that NeoGenomics' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On NeoGenomics' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given NeoGenomics' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for NeoGenomics that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here