Investor who predicted the start of the 2009 bull market: Beware of a double bottom

Legendary investor Mark Mobius is famous for a lot of things over the course of his nearly half-century career managing money, but even among his many accolades his prescient prediction of the beginning of the 2009 bull market stands out.

Perhaps it’s because it not only proved to be correct, but also proved to be the call that started the longest-running bull market in U.S. history.

But when he was asked Monday if the recent 20% rally off the bottom of the quickest bear market in history signaled an all-clear for investors, Mobius cautioned investors and stopped short of echoing his 2009 call.

“I think it's a little early to predict that because given the lockdown that we have seen globally in so many countries around the world, the impact of this lockdown on businesses, it's not going to be seen immediately,” the Mobius Capital Partners founder told Yahoo Finance’s YFi PM. “So I believe that once the numbers start coming in, people will be somewhat disappointed.”

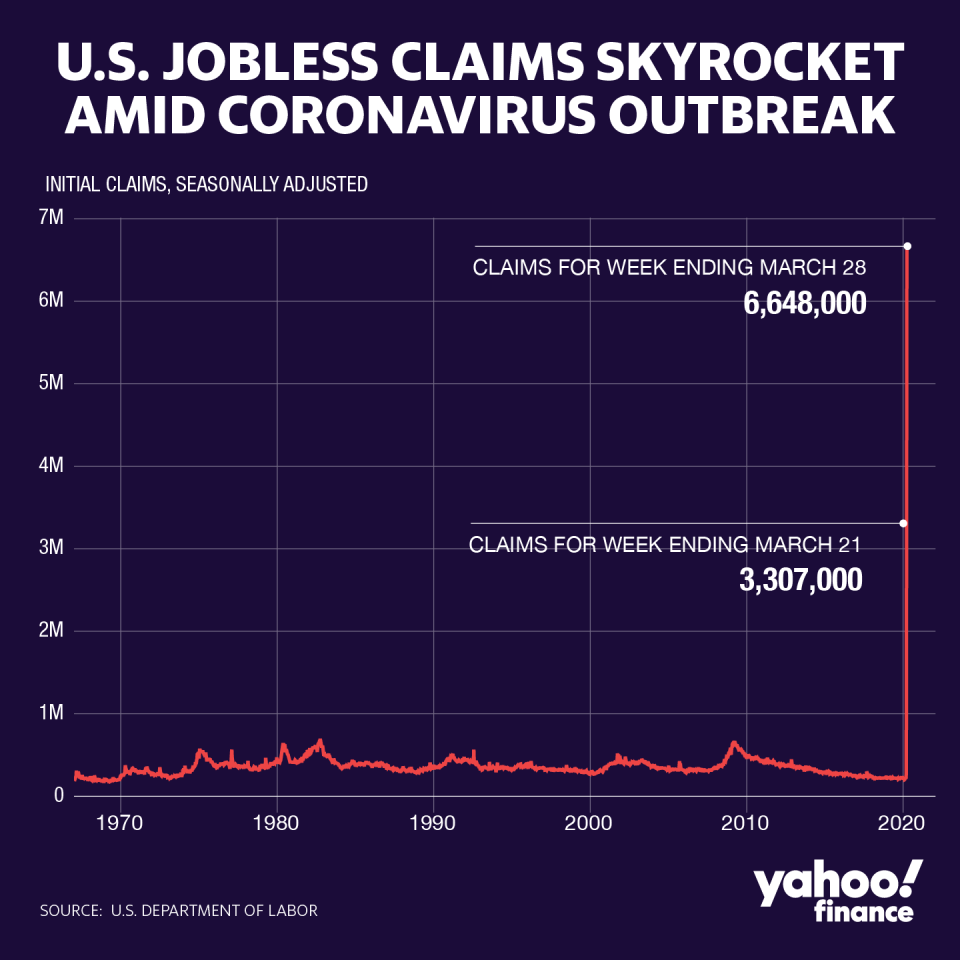

So far, at least, investors haven’t balked at the disastrous numbers of Americans filing unemployment claims. The past two weeks have set consecutive records for the sheer droves of jobless claims, totaling nearly 10 million. The S&P 500 has rallied nearly 20% over the same time period, despite the gloomy unemployment update, bringing the total peak-to-trough decline since the coronavirus crisis hit to a 20% drawdown.

As Mobius points out, historical bear markets on a global scale have averaged a larger 30% to 50% drawdown spread out over the span of roughly two years. Some have been quick to optimistically predict, however, that if the market cratered at record speed, perhaps it could recover just as fast because this time it is different. To refute the notion that lightning could strike just as quick to fuel an equal move to the upside, Mobius quoted the late John Templeton.

“The most expensive words in the world are ‘This time is different.’ I don't think this time it's different,” he said. “I think we’re probably maybe going to do a double bottom, jumping down again and pushing up again.”

Keep some reserves

That said, Mobius did concede the fact that the drawdown has brought on what he sees as attractive opportunities in some emerging markets like China, India and Brazil. For an investor looking to diversify, the noted emerging markets guru recommended a defensive strategy of allocating at least 10% of a portfolio to gold and 30% to 40% in emerging markets while saving a large cash cushion should the market take another leg lower.

“The reason why I think it's a good idea to keep reserves in cash [is] because I don’t think it’s over,” he said. “If you've got millions of unemployment claims, that means a lot of people will not be returning to the same jobs that they were at before.”

Thursday will bring what’s expected to be yet another dire update to America’s unemployment picture. According to Mobius, things are likely to continue to get worse before they get better.

“The recovery may take longer than people expect,” he predicted, barring any absence of a New Deal-like work program. “It's going to be a real challenge to get these people back to work.”

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

Barbara Corcoran says majority of her Shark Tank companies won’t make it through coronavirus

The coronavirus just doubled the risk of mass bankruptcies

Obama economist on $2 trillion coronavirus stimulus: 'I'm still not sure if it's enough'