Investors in Babcock International Group (LON:BAB) have unfortunately lost 43% over the last five years

While it may not be enough for some shareholders, we think it is good to see the Babcock International Group PLC (LON:BAB) share price up 23% in a single quarter. But if you look at the last five years the returns have not been good. In fact, the share price is down 47%, which falls well short of the return you could get by buying an index fund.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for Babcock International Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

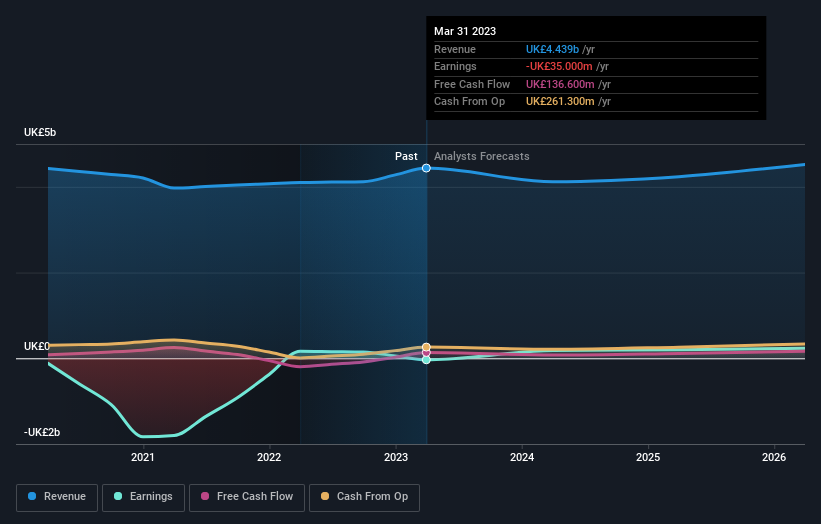

Babcock International Group became profitable within the last five years. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

The revenue decline of 2.4% isn't too bad. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Babcock International Group's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Babcock International Group's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Babcock International Group shareholders, and that cash payout explains why its total shareholder loss of 43%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

It's good to see that Babcock International Group has rewarded shareholders with a total shareholder return of 18% in the last twelve months. That certainly beats the loss of about 7% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Babcock International Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.