Investors Who Bought China Aluminum Cans Holdings (HKG:6898) Shares Five Years Ago Are Now Down 80%

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. So we wouldn't blame long term China Aluminum Cans Holdings Limited (HKG:6898) shareholders for doubting their decision to hold, with the stock down 80% over a half decade. Furthermore, it's down 11% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 14% decline in the broader market, throughout the period.

Check out our latest analysis for China Aluminum Cans Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

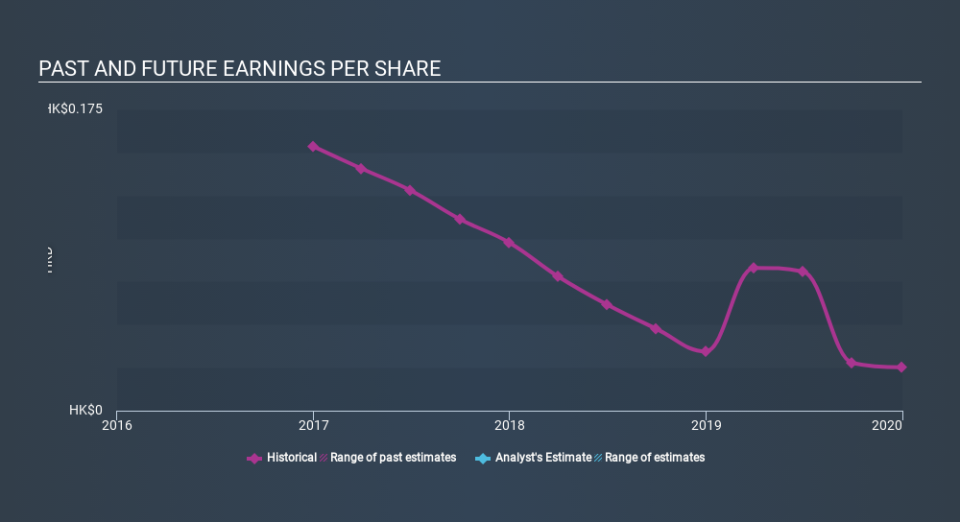

Looking back five years, both China Aluminum Cans Holdings's share price and EPS declined; the latter at a rate of 34% per year. This fall in the EPS is worse than the 27% compound annual share price fall. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of China Aluminum Cans Holdings, it has a TSR of -32% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that China Aluminum Cans Holdings shareholders have received a total shareholder return of 40% over the last year. And that does include the dividend. That certainly beats the loss of about 7.4% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for China Aluminum Cans Holdings (1 makes us a bit uncomfortable) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.