Investors Who Bought Digital Turbine (NASDAQ:APPS) Shares Three Years Ago Are Now Up 379%

Some Digital Turbine, Inc. (NASDAQ:APPS) shareholders are probably rather concerned to see the share price fall 39% over the last three months. But that doesn't change the fact that the returns over the last three years have been spectacular. The longer term view reveals that the share price is up 379% in that period. Arguably, the recent fall is to be expected after such a strong rise. The thing to consider is whether there is still too much elation around the company's prospects.

See our latest analysis for Digital Turbine

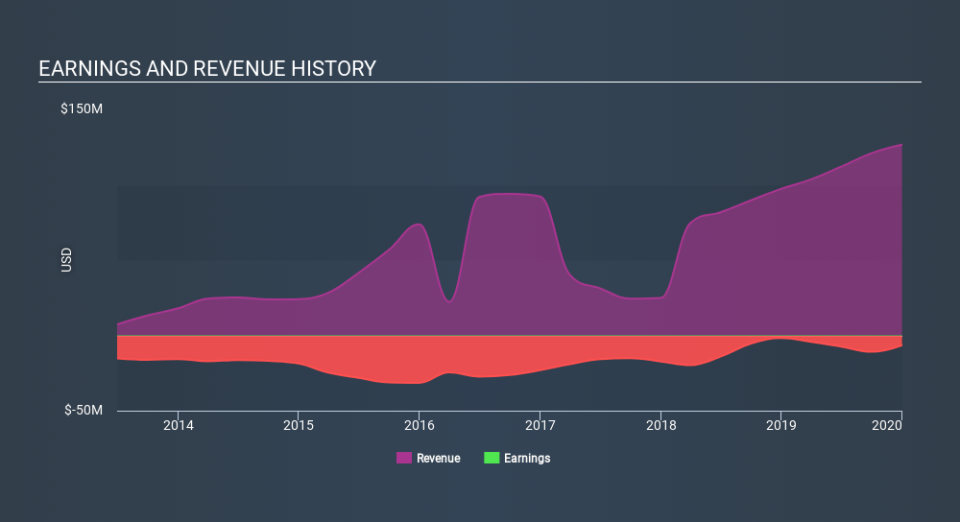

Digital Turbine wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Digital Turbine's revenue trended up 37% each year over three years. That's much better than most loss-making companies. And it's not just the revenue that is taking off. The share price is up 69% per year in that time. It's always tempting to take profits after a share price gain like that, but high-growth companies like Digital Turbine can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling Digital Turbine stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're pleased to report that Digital Turbine shareholders have received a total shareholder return of 25% over one year. That's better than the annualised return of 1.6% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Digital Turbine better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Digital Turbine you should be aware of.

Digital Turbine is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.