Investors Who Bought Murray Cod Australia (ASX:MCA) Shares A Year Ago Are Now Down 15%

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Murray Cod Australia Limited (ASX:MCA) have tasted that bitter downside in the last year, as the share price dropped 15%. That falls noticeably short of the market return of around 12%. We wouldn't rush to judgement on Murray Cod Australia because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 13% in the last three months.

Check out our latest analysis for Murray Cod Australia

Given that Murray Cod Australia didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year Murray Cod Australia saw its revenue fall by 27%. That looks pretty grim, at a glance. The stock price has languished lately, falling 15% in a year. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

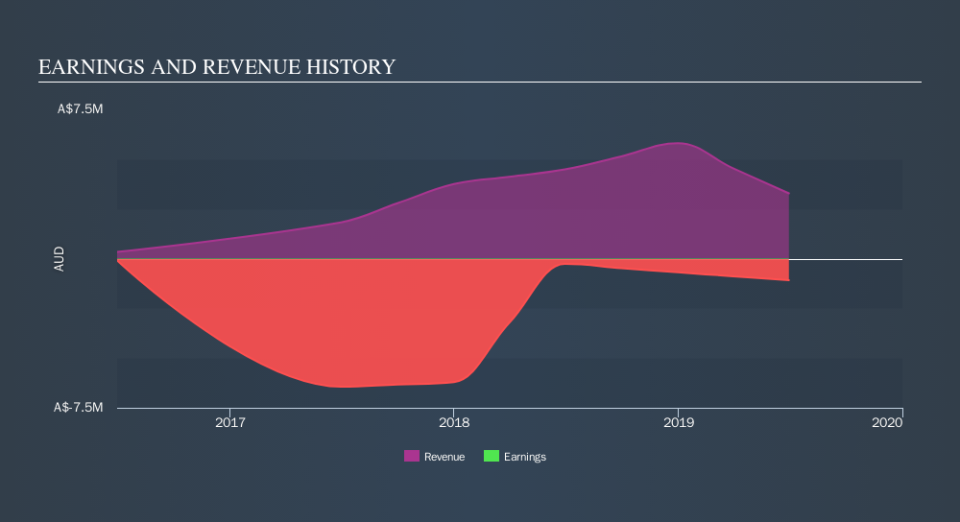

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While Murray Cod Australia shareholders are down 15% for the year, the market itself is up 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 13% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You could get a better understanding of Murray Cod Australia's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.