Investors Who Bought Qualstar (NASDAQ:QBAK) Shares Three Years Ago Are Now Up 63%

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Qualstar Corporation (NASDAQ:QBAK) share price is up 63% in the last three years, clearly besting the market return of around 39% (not including dividends).

Check out our latest analysis for Qualstar

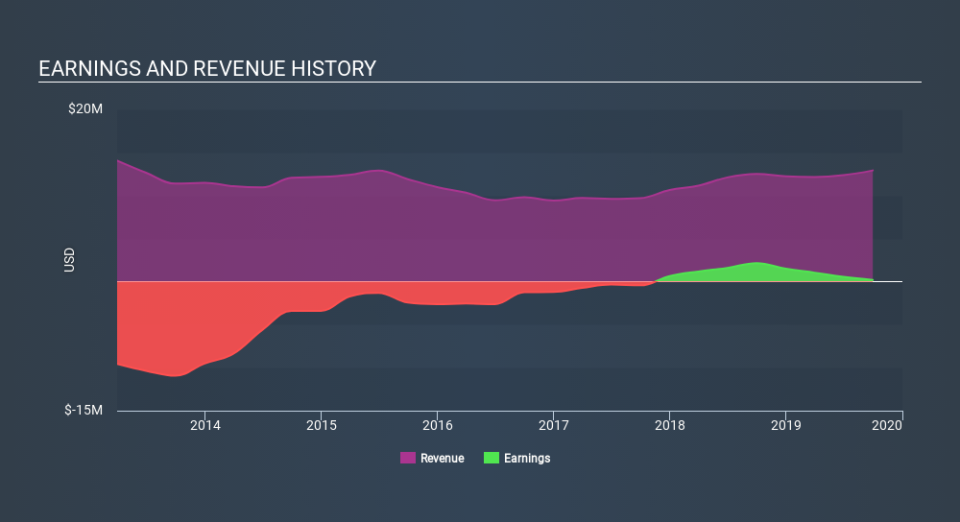

We don't think that Qualstar's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Qualstar's revenue trended up 12% each year over three years. That's pretty nice growth. The share price gain of 18% per year shows that the market is paying attention to this growth. Of course, valuation is quite sensitive to the rate of growth. Of course, it's always worth considering funding risks when a company isn't profitable.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Qualstar shareholders are down 2.3% for the year, but the market itself is up 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 8.2% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that Qualstar is showing 3 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.