Investors in Caesarstone (NASDAQ:CSTE) have unfortunately lost 65% over the last five years

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. For example the Caesarstone Ltd. (NASDAQ:CSTE) share price dropped 68% over five years. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 25%. Unfortunately the share price momentum is still quite negative, with prices down 11% in thirty days. But this could be related to poor market conditions -- stocks are down 17% in the same time.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Caesarstone

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

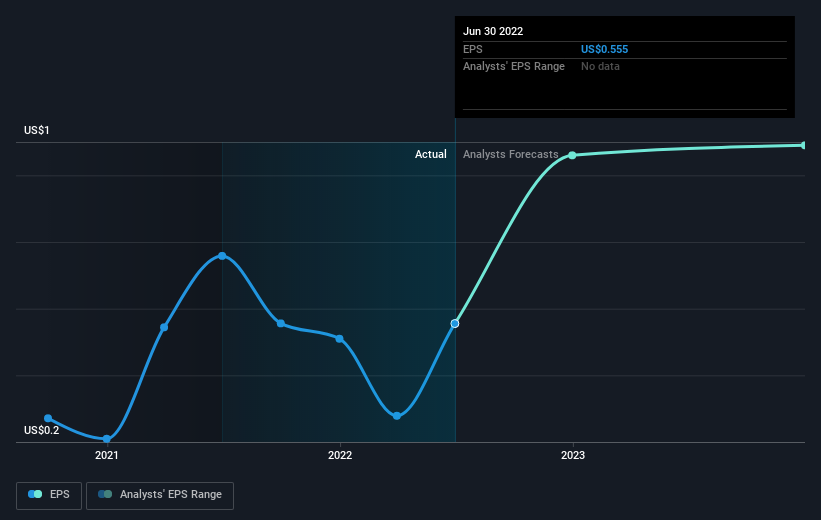

Looking back five years, both Caesarstone's share price and EPS declined; the latter at a rate of 21% per year. In this case, the EPS change is really very close to the share price drop of 21% a year. This implies that the market has had a fairly steady view of the stock. Rather, the share price change has reflected changes in earnings per share.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Caesarstone's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Caesarstone's TSR for the last 5 years was -65%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While it's never nice to take a loss, Caesarstone shareholders can take comfort that , including dividends,their trailing twelve month loss of 22% wasn't as bad as the market loss of around 44%. Given the total loss of 11% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Caesarstone is showing 2 warning signs in our investment analysis , you should know about...

Of course Caesarstone may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here