Investors in Citi Trends (NASDAQ:CTRN) have unfortunately lost 21% over the last three years

While not a mind-blowing move, it is good to see that the Citi Trends, Inc. (NASDAQ:CTRN) share price has gained 15% in the last three months. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 21% in the last three years, significantly under-performing the market.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Citi Trends

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, Citi Trends actually saw its earnings per share (EPS) improve by 52% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

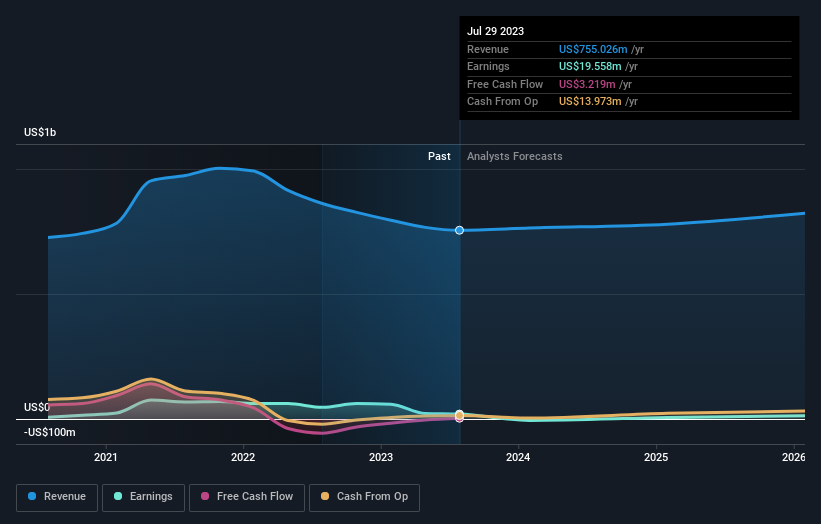

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Citi Trends has grown profits over the years, but the future is more important for shareholders. This free interactive report on Citi Trends' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Citi Trends shareholders have received returns of 10% over twelve months, which isn't far from the general market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 0.3%, which was endured over half a decade. While 'turnarounds seldom turn' there are green shoots for Citi Trends. It's always interesting to track share price performance over the longer term. But to understand Citi Trends better, we need to consider many other factors. Take risks, for example - Citi Trends has 4 warning signs we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.