Investors in CM.com (AMS:CMCOM) have unfortunately lost 53% over the last year

Taking the occasional loss comes part and parcel with investing on the stock market. Unfortunately, shareholders of CM.com N.V. (AMS:CMCOM) have suffered share price declines over the last year. To wit the share price is down 53% in that time. However, the longer term returns haven't been so bad, with the stock down 20% in the last three years. The falls have accelerated recently, with the share price down 32% in the last three months.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for CM.com

CM.com isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

CM.com grew its revenue by 19% over the last year. That's definitely a respectable growth rate. Unfortunately it seems investors wanted more, because the share price is down 53% in that time. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

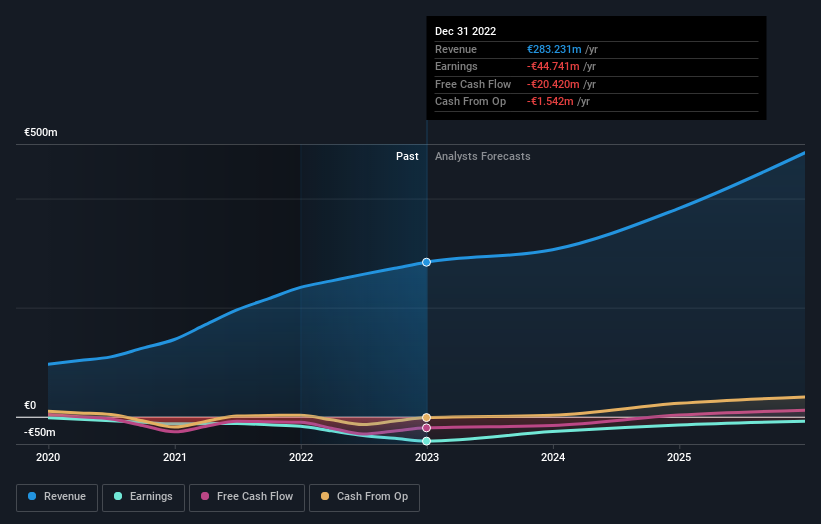

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling CM.com stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

CM.com shareholders are down 53% for the year, but the broader market is up 4.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 6% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand CM.com better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for CM.com you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here