Investors Continue Waiting On Sidelines For Harmony Gold Mining Company Limited (JSE:HAR)

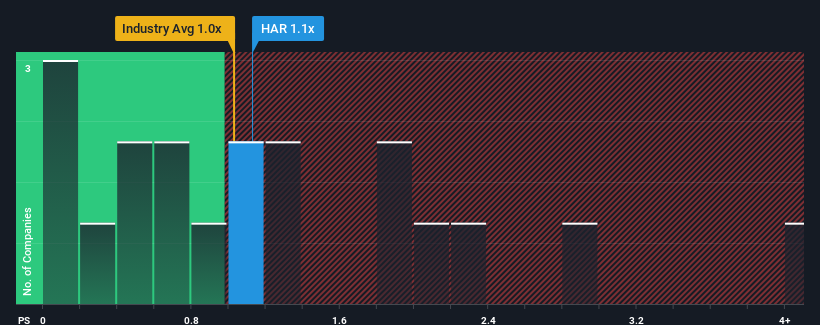

There wouldn't be many who think Harmony Gold Mining Company Limited's (JSE:HAR) price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S for the Metals and Mining industry in South Africa is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Harmony Gold Mining

How Has Harmony Gold Mining Performed Recently?

Recent times have been pleasing for Harmony Gold Mining as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. Those who are bullish on Harmony Gold Mining will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Harmony Gold Mining will help you uncover what's on the horizon.

Is There Some Revenue Growth Forecasted For Harmony Gold Mining?

In order to justify its P/S ratio, Harmony Gold Mining would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.4% last year. Pleasingly, revenue has also lifted 54% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 19% as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.9%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Harmony Gold Mining's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Harmony Gold Mining's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Harmony Gold Mining currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Harmony Gold Mining you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here