Investors in Cue Biopharma (NASDAQ:CUE) have unfortunately lost 83% over the last three years

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So spare a thought for the long term shareholders of Cue Biopharma, Inc. (NASDAQ:CUE); the share price is down a whopping 83% in the last three years. That would be a disturbing experience. The falls have accelerated recently, with the share price down 23% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Cue Biopharma

We don't think Cue Biopharma's revenue of US$1,789,227 is enough to establish significant demand. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Cue Biopharma has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Cue Biopharma investors have already had a taste of the bitterness stocks like this can leave in the mouth.

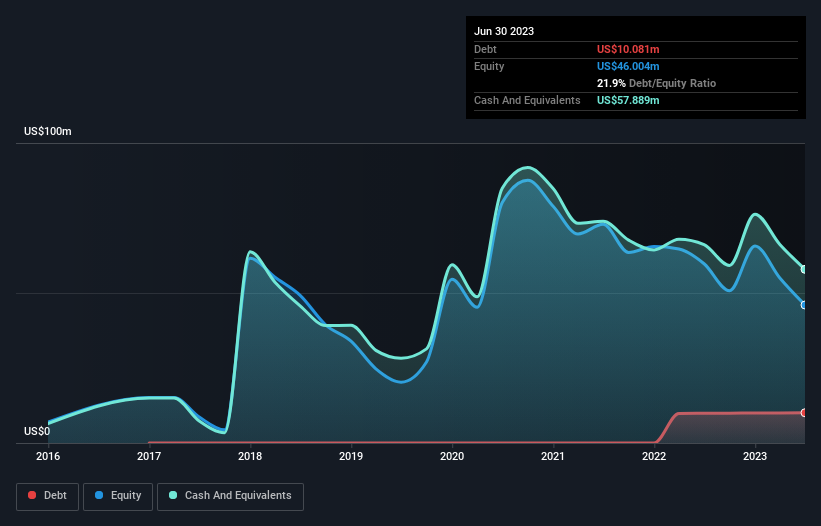

When it reported in June 2023 Cue Biopharma had minimal cash in excess of all liabilities consider its expenditure: just US$31m to be specific. So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. That probably explains why the share price is down 22% per year, over 3 years. The image below shows how Cue Biopharma's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

A Different Perspective

We're pleased to report that Cue Biopharma shareholders have received a total shareholder return of 12% over one year. That certainly beats the loss of about 9% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Cue Biopharma has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.