How Should Investors Feel About Hans Energy Company Limited’s (HKG:554) CEO Pay?

Dong Yang became the CEO of Hans Energy Company Limited (HKG:554) in 2016. First, this article will compare CEO compensation with compensation at similar sized companies. Then we’ll look at a snap shot of the business growth. And finally – as a second measure of performance – we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for Hans Energy

Want to help shape the future of investing tools? Participate in a short research study and receive a 6-month subscription to the award winning Simply Wall St research tool (valued at $60)!

How Does Dong Yang’s Compensation Compare With Similar Sized Companies?

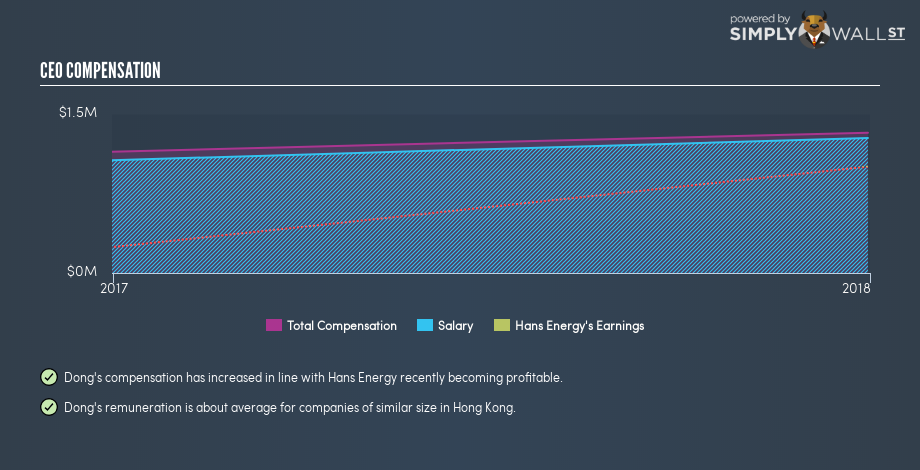

At the time of writing our data says that Hans Energy Company Limited has a market cap of HK$859m, and is paying total annual CEO compensation of HK$1.3m. (This number is for the twelve months until 2017). It is worth noting that the CEO compensation consists almost entirely of the salary, worth HK$1.3m. We examined a group of similar sized companies, with market capitalizations of below HK$1.6b. The median CEO compensation in that group is HK$1.7m.

That means Dong Yang receives fairly typical remuneration for the CEO of a company that size. Although this fact alone doesn’t tell us a great deal, it becomes more relevant when considered against the business performance.

You can see, below, how CEO compensation at Hans Energy has changed over time.

Is Hans Energy Company Limited Growing?

Hans Energy Company Limited has increased its earnings per share (EPS) by an average of 73% a year, over the last three years (using a line of best fit). It achieved revenue growth of 41% over the last year.

This demonstrates that the company has been improving recently. A good result. The combination of strong revenue growth with medium-term earnings per share improvement certainly points to the kind of growth I like to see.

Although we don’t have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Hans Energy Company Limited Been A Good Investment?

Since shareholders would have lost about 21% over three years, some Hans Energy Company Limited shareholders would surely be feeling negative emotions. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary…

Remuneration for Dong Yang is close enough to the median pay for a CEO of a similar sized company .

We’d say the company can boast of its EPS growth, but it’s disappointing to see negative shareholder returns over three years. Considering the improvement in earnings per share, one could argue that the CEO pay is appropriate, albeit not too low. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Hans Energy (free visualization of insider trades).

Of course, the past can be informative so you might be interested in considering this analytical visualization showing the company history of earnings and revenue.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.