Investors in GrafTech International (NYSE:EAF) have unfortunately lost 62% over the last three years

Investing in stocks inevitably means buying into some companies that perform poorly. Long term GrafTech International Ltd. (NYSE:EAF) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 63% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 60% lower in that time. The falls have accelerated recently, with the share price down 37% in the last three months.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for GrafTech International

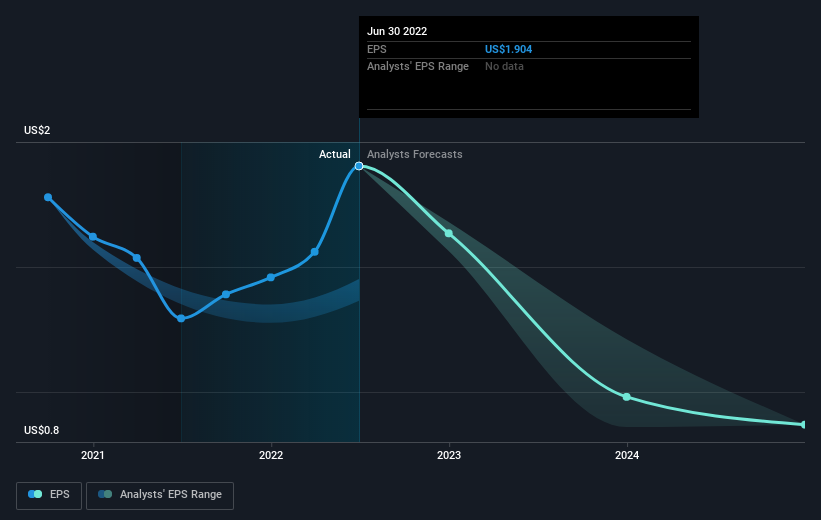

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years that the share price fell, GrafTech International's earnings per share (EPS) dropped by 12% each year. This reduction in EPS is slower than the 28% annual reduction in the share price. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 2.17.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on GrafTech International's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for GrafTech International shares, which performed worse than the market, costing holders 60%, including dividends. The market shed around 21%, no doubt weighing on the stock price. Shareholders have lost 17% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that GrafTech International is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here