Should Investors Hold on to Essex Property (ESS) Stock Now?

Essex Property Trust, Inc. ESS enjoys a sturdy property base in the West Coast market of the United States. The healthy demand for residential rental units positions the company well for growth. Also, technological initiatives to drive operational efficiency augur well. However, the supply of rental units in some markets and high interest rates make us apprehensive.

What’s Aiding it?

Essex Property has a robust presence in the West Coast market, which is home to several innovation and technology companies that drive job creation and income growth. The markets are characterized by higher median household incomes, an increased percentage of renters than owners and favorable demographics.

Moreover, with prevailing high interest rates, the cost of home ownership has risen relative to rents. This has made the transition from renter to homeowner difficult, making renting apartment units a more affordable and flexible option.

Hence, with economic activity resuming in full swing, layoffs in the tech industry slowing and return to office gaining momentum, the demand for rental residential units in this region is likely to remain healthy in the near term.

These factors are likely to enable Essex Property to generate stable rental revenues in the upcoming period. We expect a year-over-year increase of 3.8% in the company’s rental and other property revenues in 2023.

This residential real estate investment trust (REIT) is also leveraging technology, scale and organizational capabilities to drive margin expansion across its portfolio. It is making steady progress on the technology front, and leasing agents are becoming more productive by banking on these tools. Such efforts are likely to bring about operational resiliency by reducing costs and augmenting the company’s top-line and bottom-line growth.

On the balance sheet front, Essex Property had $1.7 billion of liquidity through an undrawn capacity on its unsecured credit facilities, cash, cash and marketable securities as of Nov 9, 2023. The company also enjoys investment grade credit ratings of Baa1/Stable and BBB+/Stable ratings from Moody’s Investor Service and Standard and Poor's, respectively, rendering it access to the debt market at favorable rates.

Therefore, with a solid liquidity position, manageable debt maturities and a large pool of high-quality, unencumbered assets, ESS seems well-poised to bank on long-term growth opportunities.

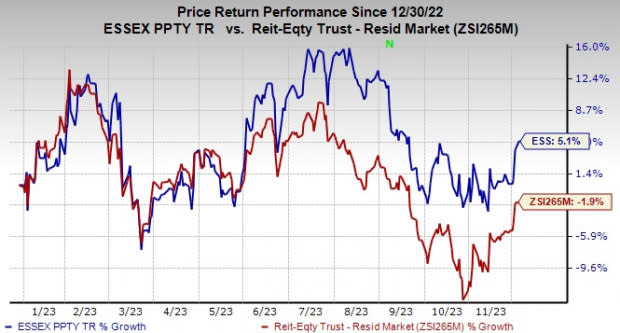

Shares of this Zacks Rank #3 (Hold) company have gained 5.1% in the year-to-date period against the industry's fall 1.9%.

Image Source: Zacks Investment Research

What’s Hurting it?

The residential real estate market is witnessing an influx of new deliveries as the construction of several projects that had been put on hold during the pandemic is nearing an end. As a result of the elevated supply in some of the markets where the company operates, its ability to increase rent is likely to be affected, curtailing its growth tempo partly. Also, with the peak leasing season coming to an end, it is expected that rent growth will moderate for the remainder of 2023.

The continuation of the remote working environment has resulted in lower renter demand for costlier and urban/infill markets, raising concerns for Essex Property’s residential units that are concentrated in the urban markets. This is likely to hurt occupancy levels at these properties.

Given the prevailing high interest rate environment, ESS may find it difficult to purchase or develop real estate with borrowed funds as the costs are likely to be on the higher side. We expect a year-over-year rise of 6.5% in the company’s current-year interest expenses.

Stocks to Consider

Some better-ranked stocks from the residential REIT sector are Invitation Home INVH, American Homes 4 Rent AMH and Centerspace CSR, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Invitation Home’s 2023 FFO per share is pegged at $1.79, suggesting year-over-year growth of 7.2%.

The Zacks Consensus Estimate for American Homes 4 Rent’s ongoing year’s FFO per share stands at $1.65, indicating growth of 7.1% from the year-ago quarter’s reported figure.

The Zacks Consensus Estimate for Centerspace’s current-year FFO per share is pegged at $4.66, implying 5.2% year-over-year growth.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

American Homes 4 Rent (AMH) : Free Stock Analysis Report

Invitation Home (INVH) : Free Stock Analysis Report

Centerspace (CSR) : Free Stock Analysis Report