Investors Holding Back On Navios Maritime Holdings Inc. (NYSE:NM)

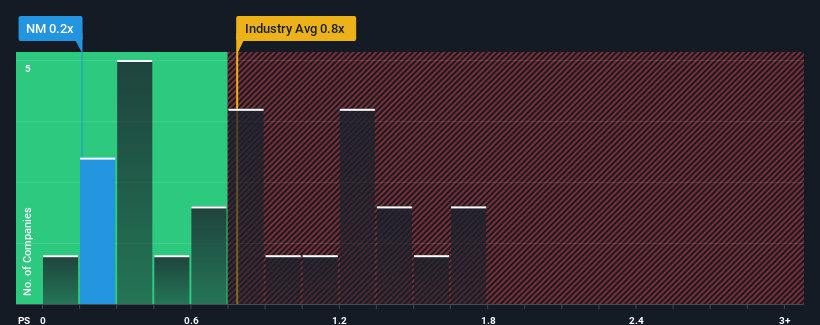

When close to half the companies operating in the Shipping industry in the United States have price-to-sales ratios (or "P/S") above 0.8x, you may consider Navios Maritime Holdings Inc. (NYSE:NM) as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Navios Maritime Holdings

What Does Navios Maritime Holdings' P/S Mean For Shareholders?

The revenue growth achieved at Navios Maritime Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Navios Maritime Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Navios Maritime Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Is There Any Revenue Growth Forecasted For Navios Maritime Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Navios Maritime Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 47% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

For that matter, there's little to separate that medium-term revenue trajectory on an annualised basis against the broader industry's one-year forecast for a contraction of 18% either.

With this information, it's perhaps strange but not a major surprise that Navios Maritime Holdings is trading at a lower P/S in comparison. In general, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Navios Maritime Holdings' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Upon examining Navios Maritime Holdings, we found that its recent revenue decline over the past three-year is affecting its P/S ratio more than we initially expected, even though the wider industry is also expected to experience a decline in revenue. When we see a revenue growth decline that is on par with its peers, we can only assume potential risks are what might be causing the P/S ratio to be lower than average. Perhaps there is some hesitation about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Navios Maritime Holdings, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here