Investors might be losing patience for Recce Pharmaceuticals' (ASX:RCE) increasing losses, as stock sheds 15% over the past week

The Recce Pharmaceuticals Ltd (ASX:RCE) share price has had a bad week, falling 15%. But that doesn't change the fact that shareholders have received really good returns over the last five years. Indeed, the share price is up an impressive 239% in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Ultimately business performance will determine whether the stock price continues the positive long term trend. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 34% decline over the last twelve months.

Since the long term performance has been good but there's been a recent pullback of 15%, let's check if the fundamentals match the share price.

Check out our latest analysis for Recce Pharmaceuticals

Recce Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Recce Pharmaceuticals saw its revenue grow at 24% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 28% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. Recce Pharmaceuticals seems like a high growth stock - so growth investors might want to add it to their watchlist.

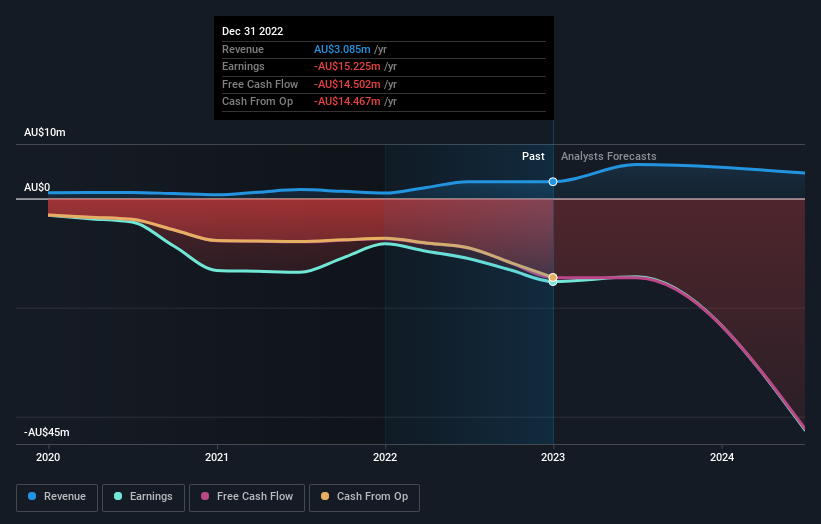

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think Recce Pharmaceuticals will earn in the future (free profit forecasts).

A Different Perspective

Recce Pharmaceuticals shareholders are down 34% for the year, but the market itself is up 7.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 28%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Recce Pharmaceuticals is showing 5 warning signs in our investment analysis , and 2 of those don't sit too well with us...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.