Investors in Montauk Renewables (NASDAQ:MNTK) from a year ago are still down 11%, even after 5.9% gain this past week

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Montauk Renewables, Inc. (NASDAQ:MNTK) have tasted that bitter downside in the last year, as the share price dropped 11%. That's disappointing when you consider the market returned 5.6%. Montauk Renewables may have better days ahead, of course; we've only looked at a one year period. In the last ninety days we've seen the share price slide 12%. However, one could argue that the price has been influenced by the general market, which is down 8.5% in the same timeframe.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Montauk Renewables

Montauk Renewables isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Montauk Renewables increased its revenue by 33%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 11%. You might even wonder if the share price was previously over-hyped. However, that's in the past now, and it's the future that matters most.

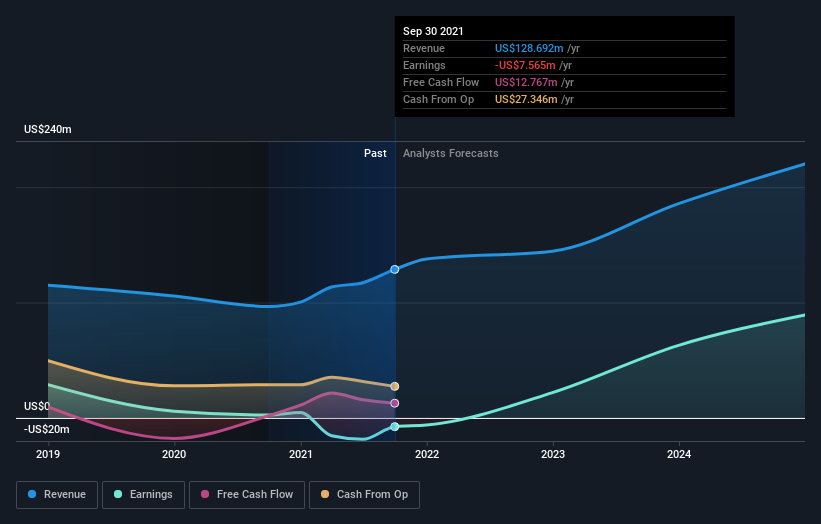

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Given that the market gained 5.6% in the last year, Montauk Renewables shareholders might be miffed that they lost 11%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's worth noting that the last three months did the real damage, with a 12% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Montauk Renewables may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.