Investors one-year losses grow to 71% as the stock sheds US$33m this past week

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it's not unreasonable to try to avoid truly shocking capital losses. It must have been painful to be a Ikena Oncology, Inc. (NASDAQ:IKNA) shareholder over the last year, since the stock price plummeted 71% in that time. That'd be enough to make even the strongest stomachs churn. Ikena Oncology hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Even worse, it's down 23% in about a month, which isn't fun at all.

After losing 19% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Ikena Oncology

Given that Ikena Oncology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Ikena Oncology increased its revenue by 180%. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 71% over twelve months. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, markets do over-react so share price drop may be too harsh.

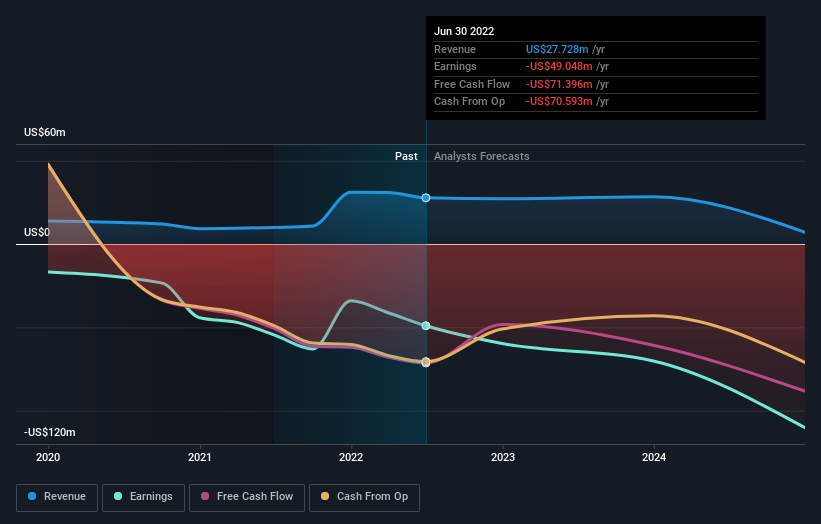

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Ikena Oncology shareholders are down 71% for the year, even worse than the market loss of 19%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 8.4% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Ikena Oncology better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Ikena Oncology (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

We will like Ikena Oncology better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here