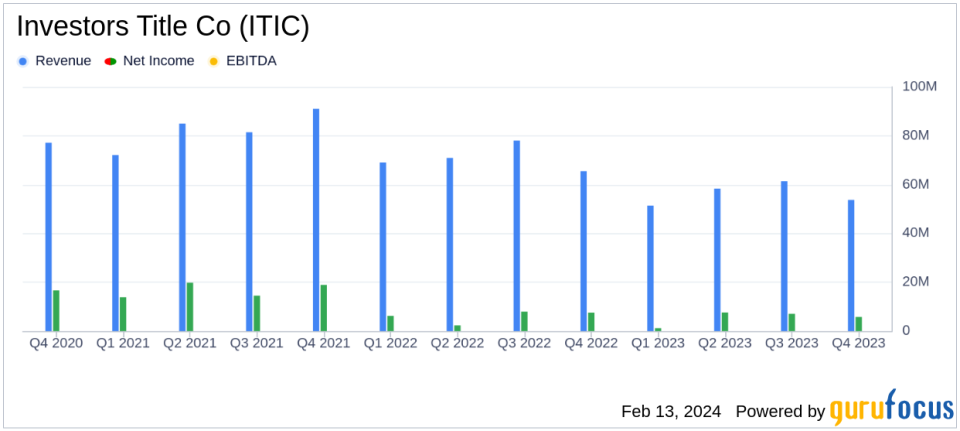

Investors Title Co Reports Decline in Q4 and Full-Year 2023 Earnings Amid Real Estate Slowdown

Net Income: Q4 net income fell 22.5% to $5.8 million; annual net income down 9.3% to $21.7 million.

Revenues: Q4 revenues dropped 18.0% to $53.7 million; annual revenues decreased 20.7% to $224.8 million.

Earnings Per Share: Diluted EPS for Q4 was $3.09, down from $3.97 in the prior year; annual diluted EPS was $11.45, down from $12.59.

Operating Expenses: Q4 operating expenses were reduced by 15.6%, reflecting lower title insurance volume.

Investment Gains: Net investment gains decreased, contributing to the revenue decline.

Market Challenges: Higher mortgage interest rates and housing inventory constraints impacted real estate transactions.

On February 13, 2024, Investors Title Co (NASDAQ:ITIC) released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, which is engaged in the issuance of residential and commercial title insurance and provides a range of related services, faced a challenging market environment characterized by a slowdown in real estate transactions.

Financial Performance Overview

The fourth quarter saw a significant decrease in net income, which dropped by 22.5% to $5.8 million, or $3.09 per diluted share, compared to $7.5 million, or $3.97 per diluted share, in the same period of the previous year. For the entire year, net income decreased by 9.3% to $21.7 million, or $11.45 per diluted share, from $23.9 million, or $12.59 per diluted share, in the prior year. Revenues for the quarter decreased by 18.0% to $53.7 million, down from $65.5 million in the prior year period, mainly due to declines in the title insurance business and net investment gains.

Operating expenses for the quarter were reduced by 15.6% compared to the prior year period, primarily due to lower title insurance volume-related expenses. Commissions to agents and personnel expenses saw significant decreases, while the provision for claims, and office and technology expenses remained consistent with the prior year period.

Market Challenges and Company's Response

The reduction in title insurance revenues is attributable to an overall decline in real estate transaction volumes resulting from higher average mortgage interest rates and ongoing housing inventory constraints. However, mortgage interest rates began trending downwards towards the end of the year, which may provide some relief in the future.

Chairman J. Allen Fine commented on the results, stating:

Results for the quarter reflect the ongoing slowdown in real estate transaction activity, as well as typical seasonal patterns. Elevated levels of interest rates continue to negatively impact home sales and mortgage refinancing. At the same time, a constrained inventory of homes for sale coupled with the lowest levels of home turnover in at least a decade has kept real estate values near their post-pandemic peaks. These factors have all converged to reduce housing affordability to historically low levels.

Despite the downturn, Investors Title Co maintained a pre-tax profit margin of 11.7% for the year, with low claims activity and investment earnings benefiting from higher interest rates and stock market gains.

Financial Statements Highlights

The company's balance sheet as of December 31, 2023, shows total assets of $330.6 million, a slight decrease from $339.8 million in the previous year. Liabilities stood at $79.0 million, down from $98.7 million, while stockholders' equity increased to $251.6 million from $241.0 million.

Direct premiums written for the quarter accounted for 31.5% of the total, while agency premiums represented 68.5%. For the full year, direct premiums were 33.9% of the total, with agency premiums making up the remaining 66.1%.

Investors Title Co's performance in the fourth quarter and throughout 2023 reflects the broader challenges faced by the real estate and title insurance industries. The company's ability to navigate these challenges while maintaining profitability demonstrates its resilience and strategic management. As the market adjusts to changing economic conditions, Investors Title Co's focus on efficiency and investment in technology may position it well for future growth.

For a detailed view of Investors Title Co's financial results, including the full income statement and balance sheet, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from Investors Title Co for further details.

This article first appeared on GuruFocus.