Do Iofina's (LON:IOF) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Iofina (LON:IOF). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Iofina

Iofina's Improving Profits

Over the last three years, Iofina has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Iofina boosted its trailing twelve month EPS from US$0.04 to US$0.05, in the last year. There's little doubt shareholders would be happy with that 25% gain.

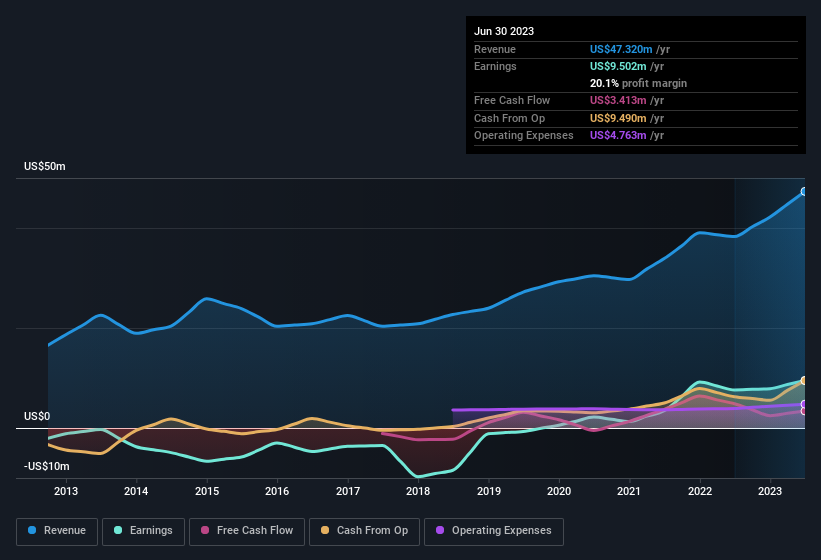

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Iofina is growing revenues, and EBIT margins improved by 10.9 percentage points to 25%, over the last year. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since Iofina is no giant, with a market capitalisation of UK£56m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Iofina Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Iofina shares, in the last year. Add in the fact that Lance Baller, the Non-Executive Chairman of the company, paid US$16k for shares at around US$0.31 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Iofina.

On top of the insider buying, we can also see that Iofina insiders own a large chunk of the company. In fact, they own 35% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have US$20m invested in the business, at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Tom Becker, is paid less than the median for similar sized companies. For companies with market capitalisations under US$200m, like Iofina, the median CEO pay is around US$349k.

The Iofina CEO received US$304k in compensation for the year ending December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Iofina Deserve A Spot On Your Watchlist?

One positive for Iofina is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. We don't want to rain on the parade too much, but we did also find 1 warning sign for Iofina that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, Iofina isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.