Ionis (IONS) Q3 Loss Wider Than Expected, Sales Beat Estimates

Ionis Pharmaceuticals IONS reported a loss of $1.03 per share for third-quarter 2023, which was wider than the Zacks Consensus Estimate of a loss of $1.01 per share.

The bottom line includes compensation expense related to equity awards. Excluding these special items, the adjusted loss per share was 85 cents per share compared with a loss of 16 cents per share in the year-ago quarter.

Total revenues were $144 million in the third quarter, which beat the Zacks Consensus Estimate of $139.0 million. Revenues declined 10% year over year due to lower payments from partnered programs.

Quarter in Detail

Ionis licensed Spinraza to Biogen BIIB. Biogen is responsible for commercializing Spinraza, approved for treating spinal muscular atrophy, or SMA, worldwide. Ionis receives royalties from Biogen on Spinraza’s sales.

Commercial revenues were $84 million in the third quarter, up 15% year over year. Commercial revenues beat the Zacks Consensus Estimate of $81 million.

Commercial revenues from Spinraza royalties were $67 million, up 8% year over. Spinraza product sales (recorded by Biogen) increased in a low single-digit range in the quarter despite competitive pressure. Spinraza royalties beat the Zacks Consensus Estimate of $61 million.

Revenues from Tegsedi and Waylivra distribution fees were $8 million compared with $6 million in the year-ago quarter. License and royalty revenues were $9 million in the quarter compared with $5 million in the year-ago quarter. Commercial revenues included royalty revenues from Biogen for Qalsody/tofersen, which was launched this year in the United States for treating superoxide dismutase 1-amyotrophic lateral sclerosis.

R&D revenues declined 31% year over year to $60 million due to the unfavorable timing of certain payments from partners. Year-ago R&D revenues included a $35 million license fee for IONIS-FB-LRx that Ionis earned from Roche, which was missing in the third quarter of 2023.

Adjusted operating costs were up 33.9% year over year to $261 million in the quarter, mainly due to higher R&D costs and investments for go-to-market activities for eplontersen, olezarsen and donidalorsen.

2023 Guidance

Ionis reaffirmed its previously issued financial guidance for 2023. The company expects total revenues to be more than $575 million in 2023. Adjusted operating expense is expected to come in at the higher end of the range of $970-$995 million.

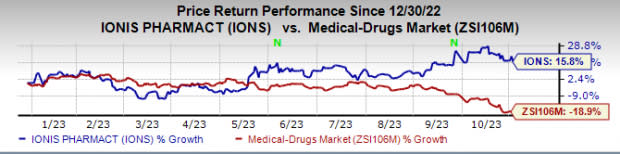

So far this year, Ionis’ shares have risen 15.8% against the industry’s decrease of 18.9%.

Image Source: Zacks Investment Research

Pipeline Update

Ionis has phase III studies ongoing for nine medicines (internal as well as partnered) across 11 indications.

Some of these candidates are pelacarsen for cardiovascular disease due to elevated Lp(a) levels, olezarsen for familial chylomicronemia syndrome (FCS) and severe hypertriglyceridemia, eplontersen for TTR amyloidosis, ulefnersen (ION363) for ALS, with mutations in the fused in sarcoma gene, or FUS (FUS-ALS); donidalorsen for the prophylactic treatment of hereditary angioedema (HAE), bepirovirsen for chronic hepatitis B; IONIS-FB-LRx for IgA Nephropathy; and zilganersen for Alexander’s disease.

AstraZeneca AZN, Novartis NVS and GSK are its partners for eplontersen, pelacarsen and bepirovirsen, respectively. Ionis and AstraZeneca’s new drug application seeking approval of eplontersen for polyneuropathy caused by hereditary TTR amyloidosis (ATTRv-PN) is under review with the FDA, with a decision expected on Dec 22, 2023. Eplontersen is also under review in the EU for the ATTRv-PN indication.

Ionis and AstraZeneca are also developing eplontersen for the treatment of cardiomyopathy in the phase III CARDIO-TTRansform study. Enrollment in the study is complete and the companies are expected to report data from the study in first-half 2025.

Ionis is advancing and expanding its wholly-owned pipeline to drive future revenue growth. In September 2023, the company released positive data from the phase III BALANCE study evaluating olezarsen in the FCS indication. The data showed that treatment with olezarsen led to significant triglyceride lowering and substantial reductions in acute pancreatitis attacks in patients with FCS. Management intends to file a new drug application for olezarsen in FCS with the FDA in early 2024, based on results from the BALANCE study. If approved, olezarsen will be Ionis’ first own medicine that it will launch independently.

Data readouts from late-stage studies on some other wholly-owned candidates – ulefnersen and donidalorsen – are expected in 2024. In the quarter, the FDA granted orphan drug designation to donidalorsen for the prophylactic treatment of HAE and ulefnersen for FUS-ALS.

Zacks Rank

Ionis currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ionis Pharmaceuticals, Inc. Price and Consensus

Ionis Pharmaceuticals, Inc. price-consensus-chart | Ionis Pharmaceuticals, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Ionis Pharmaceuticals, Inc. (IONS) : Free Stock Analysis Report