Iovance Biotherapeutics Inc (IOVA) Reports Q4 and Full Year 2023 Financial Results

Revenue: Reported $0.5 million for Q4 and $1.2 million for the full year 2023, following Proleukin acquisition.

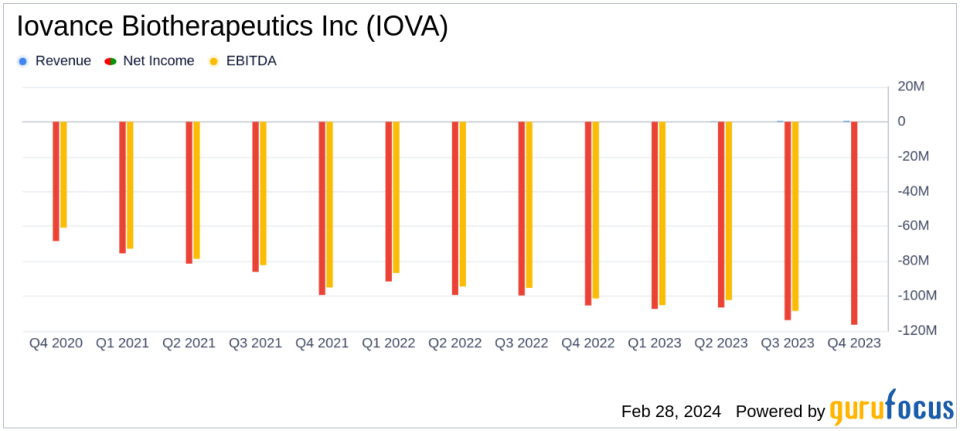

Net Loss: Increased to $116.4 million in Q4 and $444.0 million for the full year, reflecting investment in commercial and development activities.

Cash Position: Ended the year with $346.3 million, expected to fund operations well into the second half of 2025.

Research and Development: R&D expenses rose to $87.5 million in Q4, driven by manufacturing and clinical trial costs.

Selling, General and Administrative Expenses: Increased to $29.9 million in Q4, supporting business growth and Proleukin integration.

Global Expansion: Regulatory submissions for Amtagvi planned in the EU, UK, and Canada in 2024.

Stockholders' Equity: Stood at $584.6 million at the end of 2023.

On February 28, 2024, Iovance Biotherapeutics Inc (NASDAQ:IOVA) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a pioneer in the development of personalized T cell therapies for solid tumor cancers, has recently celebrated the U.S. FDA approval and commercial launch of Amtagvi (lifileucel), marking a significant milestone in its mission to lead the global TIL therapy market.

Financial Highlights and Corporate Updates

The fourth quarter and full year financial results reflect the company's strategic investments in its commercial launch and ongoing development activities. The net loss for the fourth quarter increased to $116.4 million, or $0.45 per share, from $105.3 million, or $0.64 per share, in the same period of the previous year. The full year net loss also grew to $444.0 million, or $1.89 per share, compared to $395.9 million, or $2.49 per share, in the previous year. This increase is partly due to the amortization of intangible assets acquired in the Proleukin transaction.

Despite the net loss, the company's cash position remains strong, with $346.3 million in cash, cash equivalents, investments, and restricted cash as of December 31, 2023. This is expected to fund operations well into the second half of 2025, bolstered by the net proceeds of approximately $197.1 million from a February 2024 follow-on stock offering and anticipated revenue from Amtagvi and Proleukin.

Operational Progress and Future Outlook

IOVA's operational highlights include the successful U.S. launch of Amtagvi for advanced melanoma, with plans to submit regulatory dossiers in the European Union, Canada, and the United Kingdom throughout 2024. The company has identified Amtagvi patients at nearly all of the 30 Authorized Treatment Centers (ATCs) and anticipates approximately 50 ATCs to be ready by the end of May 2024.

Research and development expenses for the fourth quarter were $87.5 million, an increase from the previous year, primarily due to the expansion of manufacturing capacity and clinical development activities. Selling, general, and administrative expenses also rose to $29.9 million for the quarter, supporting the growth of the business and the integration of Proleukin.

As IOVA continues to innovate and expand its TIL therapy pipeline, the company remains committed to its vision of transforming cancer treatment and improving patient outcomes. The recent financial results underscore the company's dedication to advancing its mission, despite the challenges inherent in the biotechnology industry.

For more detailed information, investors and interested parties are encouraged to review the full 8-K filing and to join the webcast and conference call discussing these results.

IOVA's journey is emblematic of the dynamic nature of the biotech sector, where significant investments in research and development are critical for long-term success. The company's progress and strategic planning offer valuable insights for value investors looking to understand the potential of innovative cancer therapies in the market.

For further inquiries and detailed financial analysis, readers are encouraged to visit GuruFocus.com for comprehensive investment tools and resources.

Explore the complete 8-K earnings release (here) from Iovance Biotherapeutics Inc for further details.

This article first appeared on GuruFocus.