Iovance (IOVA) Gets Positive FDA Feedback on Lung Cancer Drug

Shares of Iovance Biotherapeutics IOVA were up 21.4% on Monday after management announced positive regulatory and clinical updates on its tumor infiltrating lymphocyte ("TIL") therapy LN-145 in non-small cell lung cancer (“NSCLC”) indication.

After a Type B pre-phase III meeting with the FDA, Iovance received positive feedback from the agency officials on the study design of the ongoing phase II IOV-LUN-202 study, suggesting accelerated approval for LN-145 in NSCLC indication. The single-arm IOV-LUN-202 study is evaluating LN-145 in patients with advanced NSCLC (without driver mutations) who were previously treated with an anti-PD-1 therapy.

Based on the FDA’s feedback, Iovance completed a preliminary analysis of the IOV-LUN-202 study that included 23 NSCLC patients who received LN-145. Data from the study showed that as of Jul 6, the study achieved an objective response rate (“ORR”) of 26.1% (including one complete and five partial responses) and a disease control rate of 82.6%. The median duration of response (“mDOR”) is yet been reached.

Based on the above encouraging data, management plans to enroll a total of around 120 patients into the IOV-LUN-202 in order to support a potential regulatory filing with the FDA for an accelerated approval. It expects to complete this enrolment target before 2024-end.

Iovance plans to hold a meeting with the FDA later this year to discuss a randomized confirmatory clinical study evaluating LN-145 in frontline advanced NSCLC. Management expects this confirmatory study to be underway by the time a potential accelerated approval for the drug in NSCLC comes through.

Iovance has no marketed drugs in its portfolio. Hence, it is entirely dependent on the successful development and potential approval of its pipeline candidates. A regulatory clarity from the FDA for seeking potential approval is a positive news, considering that the company has faced several difficulties in the past while trying to satisfy the FDA’s queries on potency assays issues for its lead pipeline candidate lifileucel. Investors likely cheered the above announcement as it indicates that the FDA and company are in alignment with each other on LN-145 clinical studies in NSCLC.

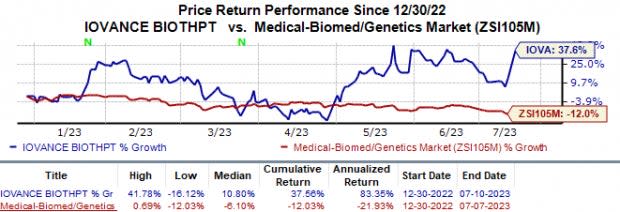

In the year so far, the stock has increased 37.6% against the industry’s 12.0% fall.

Image Source: Zacks Investment Research

A biologics license application (“BLA”) for the company’s lead candidate lifileucel is currently under FDA review, with a final decision expected before November 2023-end. The BLA seeks accelerated approval for lifileucel to treat patients with advanced melanoma, which progressed on or after prior anti-PD-1/L1 therapy.

If approved, lifileucel will be the first FDA-approved individualized, one-time cell therapy for melanoma patients. The accelerated approval to lifileucel will also cater to the needs of melanoma patients who have already been treated with standard-of-care medications and have limited treatment options.

Last month, management randomized the first patient in the phase III TILVANCE-301 study, evaluating the combination of lifileucel and Merck’s MRK PD-L1 inhibitor Keytruda (pembrolizumab) against Merck’s Keytruda in frontline metastatic melanoma. This late-stage study will also serve as a confirmatory study for the above BLA. Iovance previously evaluated the combination of lifileucel and Merck’s Keytruda for the given indication in a cohort of the phase II IOV-COM-202 study. Data from the cohort demonstrated an ORR of 67%.

A multi-center study, IOV-COM-202 is composed of seven cohorts evaluating Iovance’s TIL therapies in multiple settings and for several indications, as a monotherapy and in combination with Merck’s Keytruda or Bristol-Myers’ BMY Opdivo/Yervoy.

Opdivo and Yervoy are two of the many blockbuster drugs marketed by Bristol Myers. The drugs are key top-line drivers for Bristol Myers. During first-quarter 2023, Bristol Myers generated $2.2 billion from Opdivo sales and recorded $508 million as product revenues from Yervoy.

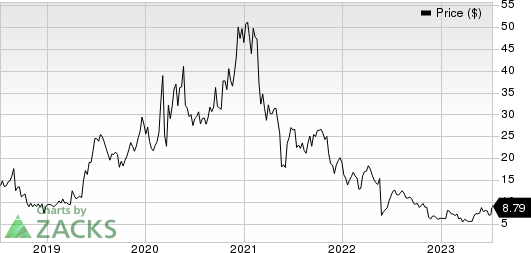

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank & Stock to Consider

Iovance currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is BioNTech SE BNTX, carrying a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for BioNTech’s 2023 earnings per share have risen from $4.62 to $5.62. During the same period, the earnings estimates per share for 2024 have increased from $3.09 to $3.48.

Earnings of BioNTech beat estimates in three of the last four quarters while missing the mark once. On average, the company’s earnings witnessed a surprise of 306.82%. In the last reported quarter, BioNTech’searnings beat estimates by 1,122.22%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report