Iovance (IOVA) Stock Rises on FDA Nod for Melanoma Drug Amtagvi

Shares of Iovance Biotherapeutics, Inc. IOVA were up 32.7% in after-hours trading on Feb 16, after the company announced that the FDA has granted an accelerated approval to its T cell immunotherapy, Amtagvi (lifileucel) suspension, to treat advanced melanoma after anti-PD-1 and targeted therapy.

Amtagvi is indicated for intravenous infusion to treat advanced unresectable or metastatic melanoma in adult patients who have been previously treated with a PD-1 blocking antibody, and if BRAF V600 mutation positive, a BRAF inhibitor with or without a MEK inhibitor.

Following the nod, Amtagvi became the first and the only one-time T cell therapy to be approved by the FDA for treating solid tumor cancer and also the first treatment option for advanced melanoma, which progressed on or after prior anti-PD-1/L1 therapy.

Amtagvi is the second product to be marketed by Iovance. The company currently markets Proleukin, which is approved by the FDA for treating two cancer indications in adults - metastatic renal cell carcinoma and metastatic melanoma.

The FDA’s accelerated approval was based on safety and efficacy data from the phase II C-144-01 study, which evaluated Amtagvi in patients with advanced melanoma previously treated with anti-PD-1 therapy and targeted therapy. Treatment with Amtagvi led to deep and durable responses in the given patient population.

The accelerated nod from the regulatory body was based on the overall response rate (ORR) and duration of response.

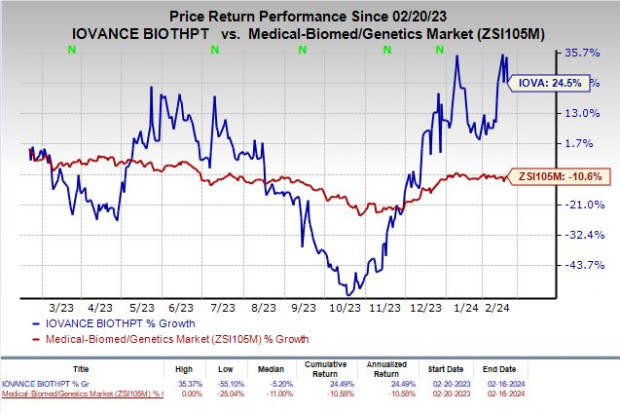

Shares of Iovance have rallied 24.5% in the past year against the industry’s decline of 10.6%.

Image Source: Zacks Investment Research

Up until now, there were no FDA-approved therapies for advanced melanoma, which progressed on or after prior anti-PD-1/L1 therapy. Hence, the approval for Amtagvi is likely to address the needs of melanoma patients who have already been treated with standard-of-care medications and have limited treatment options.

The company is also evaluating Amtagvi in the phase III TILVANCE-301 study in frontline advanced melanoma. This study is likely to confirm the clinical benefit of Amtagvi for its traditional approval in the given indication.

We note that the approval for Amtagvi comes with a boxed warning for treatment-related mortality, prolonged severe cytopenia, severe infection, as well as cardiopulmonary and renal impairment.

Amtagvi is also being studied for treating other types of solid tumors. The current approval for Amtagvi in the United States is a huge boost and provides a significant commercial opportunity for Iovance in 2024 and beyond.

Zacks Rank & Stocks to Consider

Iovance currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the healthcare sector are Exact Sciences Corp. EXAS and Puma Biotechnology, Inc. PBYI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Exact Sciences’ 2024 loss per share have narrowed from $1.22 to $1.15. In the past year, shares of EXAS have lost 4%.

Exact Sciences’ earnings beat estimates in each of the trailing four quarters. EXAS delivered an average earnings surprise of 44.21%.

In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 64 cents to 69 cents. In the past year, shares of PBYI have risen 63.1%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report