Iovance (IOVA) Surges More Than 150% in 3 Months: Here's Why

Iovance Biotherapeutics IOVA is a commercial-stage pharmaceutical company primarily focused on developing and marketing novel T cell-based cancer immunotherapies.

Currently, Iovance has only one marketed drug in its portfolio, Proleukin, which was added to its portfolio last year from U.K.-based Clinigen Limited for £166.7 million (around $200 million). This drug is approved by the FDA to treat two cancer indications in adults — metastatic renal cell carcinoma (mRCC) and metastatic melanoma.

The company is developing its lead pipeline candidate, lifileucel, as a monotherapy for treating metastatic melanoma and metastatic cervical cancer, respectively. Apart from lifileucel, management is evaluating other pipeline candidates in multiple oncology indications.

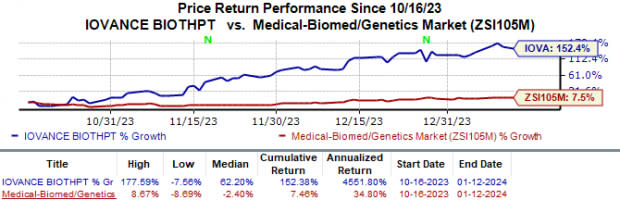

In the past three months, shares of Iovance have soared 152.4% compared with the industry’s 7.5% rise.

Image Source: Zacks Investment Research

This upside is attributable to the potential approval of the company’s biologics license application (BLA) for lifileucel to treat patients with advanced unresectable or metastatic melanoma, which progressed on or after prior anti-PD-1/L1 therapy. A final decision is expected by the end of next month.

The above BLA, which seeks accelerated approval from the FDA, is supported by data from cohorts 2 and 4 of the phase II C-144-01 study, which evaluated life in patients with post-anti-PD1 melanoma. Overall data from these cohorts shows that treatment with lifileucel achieved an objective response rate (ORR) of 31%, with the median duration of the response still not reached at 36.5 months.

The FDA is likely to be satisfied with the above data. It had previously reiterated the absence of any major review issues with the BLA and did not hold an advisory committee meeting to discuss the BLA. The agency has completed all pre-approval inspections of clinical sites and internal and external manufacturing and testing facilities.

Currently, there are no FDA-approved therapies in this treatment setting. If the BLA is approved, lifileucel will be the first FDA-approved individualized, one-time cell therapy for melanoma patients. The approval to lifileucel will cater to the needs of melanoma patients who have already been treated with standard-of-care medications and have limited treatment options.

If the BLA is approved, Iovance has prepared an expansionary strategy to more than double the total addressable advanced melanoma patient population for lifileucel. In this regard, management has planned to submit filings for lifileucel in melanoma indication in Australia, Europe and other countries throughout this year, supported by data from the C-144-01 study.

In the meantime, Iovance is enrolling participants in the phase III TILVANCE-301 study evaluating the combination of lifileucel and Merck’s PD-L1 inhibitor, Keytruda, to treat immune checkpoint inhibitor naïve frontline metastatic melanoma. This late-stage study will also serve as a confirmatory study for the above BLA.

Iovance has also been engaged in discussions with the FDA for developing lifileucel in cervical cancer. Based on these discussions, management plans to reopen enrolment in cohort 2 of the phase II C-145-04 study. The study will enroll patients who have previously received anti-PD-1 therapy. The company expects this study to support a potential BLA filing for lifileucel in cervical cancer indication.

However, the company is not immune to clinical/regulatory setbacks. Last month, the FDA placed a clinical hold on the phase II IOV-LUN-202 study evaluating LN-145 in certain patients with non-small cell lung cancer (NSCLC). The FDA placed this hold after a grade 5 (fatal) serious adverse effect, potentially related to the non-myeloablative lymphodepletion pre-conditioning regimen, was observed in the study. Any further setbacks will mar the stock’s growth prospects.

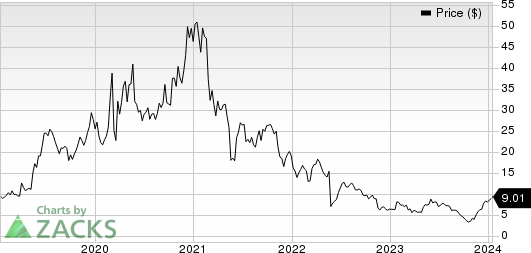

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank & Other Stocks Consider

Iovance currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector include CytomX Therapeutics CTMX, Novo Nordisk NVO and Sarepta Therapeutics SRPT. While CytomX and Novo Nordisk sport a Zacks Rank #1 (Strong Buy), Sarepta carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CytomX Therapeutics’ 2023 have improved from a loss of 10 cents per share to earnings of 6 cents. During the same period, the loss estimates per share for 2024 have narrowed from 22 cents to 6 cents. Shares of CytomX have lost 39.5% in the past year.

CytomX Therapeutics’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 45.44%. In the last reported quarter, CytomX Therapeutics’ earnings beat estimates by 123.53%.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $2.62 to $2.63. During the same period, the earnings estimates for 2024 have risen from $3.07 to $3.12. Shares of NVO have surged 57.2% in the past year.

Novo Nordisk’s earnings beat estimates in two of the last four quarters while meeting the mark on one occasion and missing the estimates on another. On average, the company witnessed an average surprise of 0.58%. In the last reported quarter, Novo Nordisk’s earnings beat estimates by 5.80%.

In the past 60 days, Sarepta’s loss estimates for 2023 have improved from a loss of $7.53 per share to $6.62 per share. During the same period, earnings estimates per share for 2024 have risen from 46 cents to $1.99. Sarepta’s shares have lost 7.8% in the past year.

Sarepta’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 48.67%. In the last reported quarter, Sarepta’s earnings beat estimates by 72.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report