Iovance's (IOVA) Meets Q3 Earnings, Lags Sales Estimates

Iovance Biotherapeutics, Inc. IOVA incurred a loss of 46 cents per share in third-quarter 2023, in line with the Zacks Consensus Estimate. In the year-ago quarter, the company reported a loss of 63 cents.

During the quarter, the company generated total revenues of $0.5 million — entirely from product sales of its recently-acquired interleukin-2 (IL-2) product Proleukin (aldesleukin). The reported sales missed the Zacks Consensus Estimate of $3.8 million. In the year-ago quarter, Iovance did not record any revenues.

Quarter in Detail

Following the completion of worldwide rights to Proleukin from U.K.-based Clinigen Limited in May 2023, Iovance is now a commercial-stage company. Proleukin is approved by the FDA for treating two cancer indications in adults — metastatic renal cell carcinoma (mRCC) and metastatic melanoma.

The reported Proleukin sales of $0.5 million also missed our model estimates of $4 million.

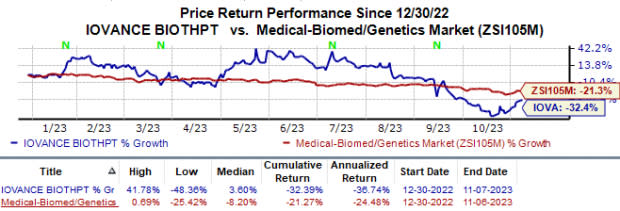

Shares of Iovance were down 1.4% in after-market trading on Nov 7, likely due to the lower-than-anticipated Proleukin sales. Year to date, the stock has declined 32.4% compared with the industry’s 21.3% fall.

Image Source: Zacks Investment Research

Research & development (R&D) expenses were $87.5 million, up 21% from the year-ago quarter’s levels. The upside was primarily due to growth of the internal R&D team and increased expenses on the initiation of new clinical studies.

Selling, general and administrative expenses (SG&A) declined 3% from the prior-year quarter’s figure to $27.0 million. The downside can be attributed to a fall in stock-based compensation expenses and other costs.

The company had $427.8 million in cash, cash equivalents, short-term investments and restricted cash as of Sep 30, 2023, compared with $317.3 million on Jun 30, 2023. During the quarter, Iovance raised around $203.2 million in net proceeds from its public offering and the at-the-market (ATM) equity financing facility. This cash balance is expected to fund the company’s current and planned operations into 2025.

Pipeline Updates

This May, the FDA accepted Iovance’s biologics license application (BLA) submission for a lead pipeline drug, lifileucel, in melanoma indication. The BLA seeks accelerated approval for lifileucel to treat patients with advanced unresectable or metastatic melanoma, which progressed on or after prior anti-PD-1/L1 therapy. Though a final decision is expected before February 2024-end, management is actively working with the agency to expedite the review process.

After receiving positive regulatory feedback from other ex-U.S. regulatory authorities, management plans to file regulatory submissions for lifileucel in melanoma indication in Europe and Canada next year.

Recently, Iovance randomized the first patient in the phase III TILVANCE-301 study, evaluating the combination of lifileucel and Merck’s blockbuster PD-L1 inhibitor, Keytruda, to treat immune checkpoint inhibitor naïve frontline metastatic melanoma. This late-stage study will serve as a confirmatory study at the time of seeking full approval for the above BLA.

Other than lifileucel, Iovance is evaluating another TIL therapy, LN-145, as a potential treatment for head and neck squamous cell carcinoma (HNSCC) and non-small cell lung cancer (NSCLC) in two separate mid-stage studies, C-145-03 and IOV-LUN-202, respectively.

After receiving positive feedback from the FDA on the IOV-LUN-202 study design, management believes that the study can serve as a registrational study that could support accelerated approval for LN-145 in post-anti-PD-1 NSCLC indication.

Iovance plans to meet with the FDA in early 2024 to discuss a potential registrational study on the combination of lifileucel and Keytruda after standard-of-care chemotherapy to serve as the confirmatory study for IOV-LUN-202 in post-anti-PD-1 melanoma and support accelerated approval in frontline advanced NSCLC.

Iovance intends to expand its clinical pipeline with a new TIL therapy program in endometrial cancer indication. In this regard, management plans to start a phase I/II study in mismatch repair (MMR) deficient and MMR proficient patient populations in first-half 2024.

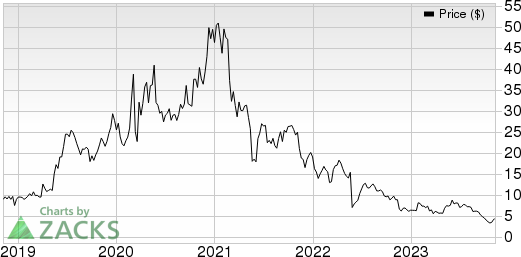

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Iovance currently has a Zacks Rank #4 (Sell). Some better-ranked stocks in the overall healthcare sector include Acadia Pharmaceuticals ACAD, Allogene Therapeutics ALLO and Apellis Pharmaceuticals APLS, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for Acadia’s 2023 loss per share have narrowed from 41 cents to 35 cents. During the same period, the earnings estimates per share for 2024 have risen from 60 cents to 79 cents. Shares of ACAD are up 47.6% in the year-to-date period.

Earnings of Acadia beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing an average earnings surprise of 20.33%. In the last reported quarter, Acadia’s earnings beat estimates by 108.33%.

Allogene’s loss estimate has narrowed from $2.25 to $2.19 per share in the past 30 days. During the same period, the loss estimates per share for 2024 have narrowed from $2.21 to $2.13. Shares of ALLO have plunged 47.9% in the year-to-date period.

The earnings of Allogene beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an average earnings surprise of 3.93%. Allogene’s earnings beat estimates by 10.17%.

Apellis Pharmaceuticals’ loss estimates for 2024 have narrowed from $2.41 to $1.94 per share in the past 30 days. Year to date, Apellis Pharmaceuticals’ stock has lost 8.5%.

Apellis Pharmaceuticals beat earnings estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing a negative earnings surprise of 3.91% on average. In the last reported quarter, APLS reported a negative earnings surprise of 39.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report