IPG Photonics Corp (IPGP) Reports Mixed Q4 Results Amidst Global Challenges

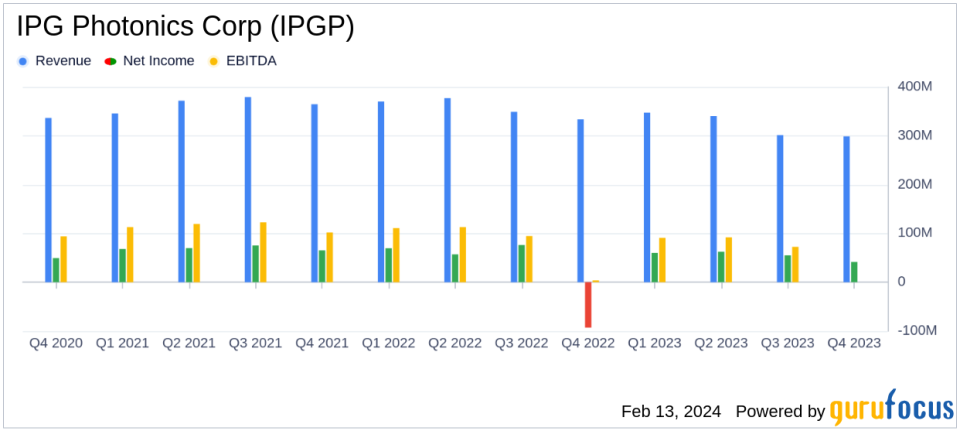

Revenue: Q4 revenue decreased by 10% year-over-year to $298.9 million.

Gross Margin: Improved to 38.2% in Q4 from 18.2% in the same period last year.

Operating Income: Reported at $28.8 million, a significant turnaround from the $88.5 million loss in Q4 2022.

Net Income: Attributable to IPGP was $41.4 million, recovering from a $92.9 million loss year-over-year.

Earnings Per Share (EPS): Increased to $0.89, up from a loss of $1.91 per diluted share in the prior year.

Cash Flow: Generated $106 million in cash from operations during the quarter.

Stock Buyback: Board authorized a new stock repurchase program of up to $300 million.

On February 13, 2024, IPG Photonics Corp (NASDAQ:IPGP) released its 8-K filing, disclosing its financial results for the fourth quarter ended December 31, 2023. The company, a leading developer and manufacturer of high-performance fiber lasers and amplifiers, faced a challenging quarter with a 10% decline in revenue compared to the same period last year. Despite this, IPG Photonics saw an improvement in gross margin and a remarkable recovery in operating income and net income attributable to the company.

IPG Photonics' financial performance reflects the ongoing global economic challenges and competitive pressures, particularly in China, which is a significant market for the company. The decline in revenue was attributed to soft industrial demand across major geographies and lower sales in e-mobility applications in China. However, the company experienced growth in welding, cleaning, 3D printing, and medical applications, which helped offset some of the declines.

The improvement in gross margin was primarily due to a significantly lower inventory provision, although it was partially offset by reduced absorption of manufacturing expenses. The turnaround in operating income from a loss in the previous year to a profit of $28.8 million is a testament to the company's operational efficiency and cost management efforts.

Financial Performance Analysis

IPG Photonics' earnings per diluted share (EPS) showed a strong recovery, coming in at $0.89 compared to a loss in the prior year. This increase is significant for investors as EPS is a key indicator of a company's profitability. The effective tax rate for the quarter was 2%, benefiting from certain discrete items.

The company's balance sheet remains robust, with cash and cash equivalents of $514.7 million as of December 31, 2023. IPG Photonics' commitment to returning capital to shareholders was evident in its $64 million expenditure on share repurchases during the quarter. The authorization of a new $300 million stock buyback program further underscores this commitment.

Looking ahead, IPG Photonics provided guidance for the first quarter of 2024, expecting revenue between $235 million and $265 million, and earnings per diluted share in the range of $0.30 to $0.60. The company anticipates challenges at the start of the year but expects demand to improve as the year progresses. IPG Photonics is focusing on operational improvements, such as lowering product costs, managing expenses, and reducing inventories to navigate the uncertain macroeconomic environment.

In conclusion, while IPG Photonics faces headwinds from global industrial demand and competition, its diversified growth in emerging products and disciplined working capital management have allowed it to maintain a strong financial position. The company's strategic focus on developing new markets and applications for its lasers, along with its operational efficiency initiatives, positions it to potentially benefit from future market recoveries.

For more detailed financial information and the full earnings call presentation, investors can visit the investor relations section of IPG Photonics' website.

Explore the complete 8-K earnings release (here) from IPG Photonics Corp for further details.

This article first appeared on GuruFocus.