IPG Photonics' (IPGP) Q2 Earnings Beat, Revenues Decrease Y/Y

IPG Photonics IPGP reported second-quarter 2023 earnings of $1.31 per share, beating the Zacks Consensus Estimate by 5.65%.

Revenues of $340 million decreased 9.8% on a year-over-year basis and lagged the consensus mark by 1.04%. Emerging growth product sales accounted for 41% of revenues.

Unfavorable forex hurt revenue growth by 2%, whereas business divestitures reduced it by roughly 1%.

IPGP shares have gained 38.9% year to date, underperforming the Zacks Computer & Technology sector’s increase of 43.1%.

Quarterly Details

Materials processing (92% of total revenues) decreased 10% year over year. The downside can be attributed to lower revenues from cutting and marking applications.

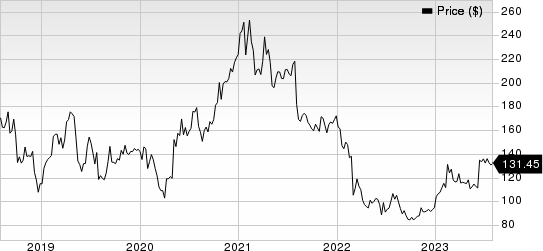

IPG Photonics Corporation Price

IPG Photonics Corporation price | IPG Photonics Corporation Quote

Revenues from other applications decreased 23% year over year due to lower revenues from advanced applications and medical.

Sales of high-power CW lasers were down 10% year over year due to lower demand in flat sheet cutting applications. Pulsed laser sales declined 24% year over year due to lower demand in foil cutting and marking applications.

Sales decreased 11% in North America and 28% in China, on a year-over-year basis. However, sales increased 14% year over year in Japan and 4% in Europe.

IPG Photonics reported a gross margin of 43.4%, down 230 basis points on a year-over-year basis.

Balance Sheet

As of Jun 30, 2023, IPG Photonics had $1.10 billion in cash & cash equivalents compared with $1.07 billion as of Mar 31, 2023.

Guidance

For third-quarter 2023, IPG Photonics anticipates sales to be $300-$330 million. Earnings are projected between 85 cents per share and $1.15 per share.

Zacks Rank & Stocks to Consider

IPG Photonics currently carries a Zacks Rank #3 (Hold).

BILL Holdings BILL, Fortinet FTNT and Itron ITRI are some better-ranked stocks that investors can consider in the broader sector. While both Fortinet and Itron sport a Zacks Rank #1 (Strong Buy) each, BILL Holdings carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BILL Holdings shares have gained 15% year to date. BILL is set to report its fourth-quarter 2023 results on Aug 17.

Fortinet shares have gained 59% year to date. FTNT is set to report its second-quarter 2023 results on Aug 3.

Itron shares have gained 55.3% year to date. ITRI is set to report its second-quarter 2023 results on Aug 3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

IPG Photonics Corporation (IPGP) : Free Stock Analysis Report

BILL Holdings, Inc. (BILL) : Free Stock Analysis Report