IPG Photonics' (IPGP) Q3 Earnings Beat, Revenues Decrease Y/Y

IPG Photonics IPGP reported third-quarter 2023 earnings of $1.16 per share, beating the Zacks Consensus Estimate by 14.9%. The figure declined 21.1% year over year.

Revenues of $301.4 million decreased 13.6% on a year-over-year basis and lagged the consensus mark by 3.68%. Emerging growth product sales accounted for 42% of revenues.

Unfavorable forex hurt revenue growth by 2%.

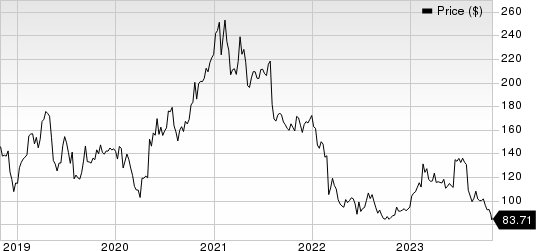

IPGP shares have declined 11.6% year to date, underperforming the Zacks Computer & Technology sector’s increase of 29.8%.

Quarterly Details

Materials processing (88% of total revenues) decreased 15% year over year. The downside can be attributed to lower revenues from cutting, welding and marking applications in China.

IPG Photonics Corporation Price

IPG Photonics Corporation price | IPG Photonics Corporation Quote

Revenues from other applications decreased 1% year over year due to lower revenues from advanced and telecom applications.

Sales of high-power CW lasers were down 22% year over year due to lower demand in flat sheet cutting applications and reduced demand in welding applications due to the timing of projects.

Pulsed laser sales declined 25% year over year due to lower demand in marking and solar cell manufacturing applications.

Sales decreased 13% in North America and 28% in China on a year-over-year basis. However, sales increased 41% year over year in Japan and 3% in Europe.

IPG Photonics reported a gross margin of 44.1%, up 100 basis points on a year-over-year basis.

Balance Sheet

As of Sep 30, 2023, IPG Photonics had $1.10 billion in cash & cash equivalents compared with $1.10 billion as of Jun 30, 2023.

Guidance

For fourth-quarter 2023, IPG Photonics anticipates sales to be $270-$300 million. Earnings are projected between 80 cents per share and $1.10 per share.

Zacks Rank & Stocks to Consider

IPG Photonics currently carries a Zacks Rank #4 (Sell).

eGain EGAN, GoDaddy GDDY and Itron ITRI are some better-ranked stocks that investors can consider in the broader sector, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

eGain shares have declined 33.9% year to date. EGAN is set to report its first-quarter fiscal 2024 results on Nov 2.

GoDaddy shares have declined 3.3% year to date. GDDY is set to report its third-quarter 2023 results on Nov 2.

Itron shares have returned 12.2% year to date. ITRI is set to report its third-quarter 2023 results on Nov 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

eGain Corporation (EGAN) : Free Stock Analysis Report

GoDaddy Inc. (GDDY) : Free Stock Analysis Report

IPG Photonics Corporation (IPGP) : Free Stock Analysis Report